Homeowners Insurance Quotes in Auburn, Alabama

What You Should Know About Home Insurance in Auburn

Nestled in the heart of east-central Alabama, Auburn is best known as the proud home of Auburn University and the spirited “War Eagle” battle cry. With its mix of historic neighborhoods, modern development, and college-town energy, Auburn offers a high quality of life—making it a popular place to settle down. But like anywhere in the South, protecting your home with the right insurance is essential.

In Auburn, the average cost of homeowners insurance tends to be lower than the national average, thanks in part to the city’s inland location and moderate exposure to severe storms. However, weather events like tornadoes, thunderstorms, and occasional hail can still cause damage, so comprehensive coverage is key. Alabama is also one of several states where windstorm deductibles may apply, particularly for named storms.

Many homes in Auburn are located near landmarks like Toomer’s Corner, Kiesel Park, and the Jule Collins Smith Museum of Fine Art. Whether you’re buying a historic craftsman near downtown or a new build in the Auburn-Opelika suburbs, it’s important to ensure your coverage reflects the true replacement cost of your home—not just market value.

Bundling policies, improving home safety features, and reviewing your deductible options can help you save. And with Auburn’s mix of charm and progress, investing in strong home insurance with InsureOne is one of the smartest steps you can take to protect your slice of the Loveliest Village on the Plains.

How Much Does a Homeowners Insurance Policy Typically Cost in Auburn?

Homeowners insurance in Auburn tends to be more affordable than the Alabama state average, thanks to the city’s inland location and lower exposure to coastal storms. According to multiple recent studies, the average annual home insurance premium in Auburn ranges from $2,028 to $3,095 annually. For a typical home insured for around $300,000 replacement value, a ballpark range of $1,500–$2,100/year is common.

Here is a chart to show you an example of average costs in the Auburn area.

| Dwelling Insurance Total | Average Annual Cost in Auburn | Average Annual Cost Nationwide |

|---|---|---|

| $300K | $1,940 | $2,582 |

| $500K | $2,934 | $4,140 |

| $1 million | $5,934 | $7,380 |

We arrived at these numbers by using the cost of dwelling coverage, a $100,000 liability and a standard $1,000 deductible.

How Do Home Insurance Deductibles Change Insurance Rates in Auburn?

In Auburn, as in the rest of Alabama, your home insurance deductible plays a major role in determining how much you pay for coverage each year. Simply put, the higher your deductible, the lower your premium.

A deductible is the amount you pay out of pocket before your insurance kicks in after a covered loss. Most homeowners in Auburn choose a standard deductible between $500 and $2,500, although higher deductibles—especially for wind or named storms—are increasingly common in Alabama.

For example, increasing your deductible from $500 to $1,500 can reduce your annual premium by 15% to 25%, depending on your insurer. This can mean substantial savings over time—especially if you have a good claims history and can afford to cover more upfront in an emergency.

It’s also important to know that many policies in Alabama, including in Auburn, may include a separate wind/hail or hurricane deductible, often calculated as a percentage of your home’s insured value—usually 1% to 5%. This means a $300,000 home with a 2% wind deductible would require you to pay $6,000 before coverage kicks in for storm damage.

Before raising your deductible to save money, consider your financial comfort level and read up on common home insurance myths so you understand the facts. A lower premium is great—but only if you’re confident you can manage the deductible in the event of a loss. Auburn homeowners benefit most when they strike the right balance between monthly affordability and reliable coverage.

Is Home Insurance Tax Deductible in Auburn?

If you live in Auburn and use your home as your primary residence, homeowners insurance premiums are not tax deductible—at the federal or Alabama state level. The IRS classifies insurance premiums for fire, theft, flood, or wind coverage as personal, non‑deductible expenses compliant with standard rules.

There are some exceptions where deduction may apply, including:

- Home Office Deduction: If you’re self-employed and use a portion of your home exclusively and regularly as your principal place of business, you may deduct a proportional share of your homeowners insurance—calculated based on square footage—and report it on Schedule C.

- Rental or Investment Property: If part or all of your home is rented out, insurance premiums for the rented portion are considered a business expense and can be deducted on Schedule E.

- Casualty Losses After Disasters: If you suffer a sudden, federally declared disaster—and insurance only covers part of the damage—you may deduct unreimbursed losses (including your deductible) on Schedule A, subject to IRS limits: a $100 floor per event and over 10% of your AGI.

Does Auburn Have the 80% Homeowners Insurance Rule?

Yes—like most cities across the U.S., Auburn follows the 80% homeowners insurance rule, which plays a big role in how much you’re reimbursed after a claim. This rule isn’t unique to Auburn or Alabama; it’s a common industry standard built into most homeowners policies nationwide.

The 80% rule says that you must insure your home for at least 80% of its total replacement cost—not the market value—in order to receive full coverage for partial losses. If you’re under that threshold, your insurance payout could be reduced, even if the damage is relatively small.

In Auburn—where construction and labor costs are steadily rising—it’s important to review your policy regularly to make sure your coverage keeps up with inflation, home improvements, or changes in materials pricing. Ask your insurance agent for a replacement cost estimate, and consider adding extended or guaranteed replacement coverage for extra protection.

Staying above the 80% mark helps ensure your home is fully protected—no surprises, no shortfalls.

Bundling Home and Auto Insurance in Auburn

Bundling your homeowners and auto insurance in Auburn can lead to meaningful savings and smoother policy management—especially given Alabama’s insurer landscape. Whether you’re in the suburbs or near Auburn University, combining policies is worth exploring.

Bundling works for both insurer and policyholder:

- Insurers like loyalty: Multi-line customers often receive better pricing as they’re less likely to leave.

- Bundling can come with additional perks: simplified billing, unified claim reporting, and even extended coverage options.

Although bundling may seem like the perfect plan, there are steps to take to protect yourself, including:

- Some providers may only discount one line of business depending on your state or policy bundle.

- Don’t assume bundling is automatically best—some independent agents report that separate policies may still yield lower rates depending on company specifics and your profile.

For Auburn homeowners, bundling home and auto insurance often delivers solid savings—up to 20–23% with top carriers like you will find with InsureOne. Beyond cost, bundling simplifies management and can unlock premium perks. Just be sure to compare options, review coverage details, and consider using an independent agent to maximize value.

What Weather Affects Home Insurance Costs in Alabama?

Alabama’s weather is as beautiful as it is unpredictable—and that directly affects the cost of home insurance across the state. From severe storms to extreme heat, insurers consider multiple weather-related risks when setting your premium.

Tornadoes and Thunderstorms

Alabama is one of the most tornado-prone states in the U.S., especially in areas like Tuscaloosa, Birmingham, and parts of the eastern region near Auburn. Spring and fall storms often bring high winds, hail, and heavy rain—all of which increase the likelihood of claims. As a result, homeowners in affected areas often face higher premiums or wind/hail deductibles.

Flooding

While standard home insurance policies do not cover flood damage, the risk of flash flooding and rising water still plays a role in pricing. Properties in FEMA-designated flood zones may need separate flood insurance, which adds to the total cost of protection.

Hurricanes and Tropical Storms

Although Alabama is farther inland than coastal states like Louisiana or Florida, it still feels the effects of Gulf storms. Mobile and Baldwin counties, in particular, are susceptible to storm surge and wind damage, leading to higher premiums and named storm deductibles.

Heat and Humidity

Alabama’s long, hot summers contribute to mold growth, roof wear, and other maintenance issues that insurers factor into long-term risk—and that may impact policy cost or coverage terms.

Whether you live in Auburn, Huntsville, or Gulf Shores, understanding how weather shapes your coverage helps you make smarter insurance decisions—and protect your home from whatever Alabama skies may bring.

What Are 4 Different Types of Homeowners Coverage Offered in Auburn?

When shopping for homeowners insurance in Auburn, understanding the different types of coverage is key to making sure your home—and everything in it—is protected. While policies can be customized, most insurers offer four core types of coverage that serve as the foundation of a standard homeowners policy:

- Dwelling Coverage (Coverage A)

This protects the structure of your home itself—walls, roof, foundation, and any attached structures like garages or porches. If your home is damaged by a covered peril like fire, wind, or hail (all common in Alabama), this coverage helps pay for repairs or rebuilding.

- Personal Property Coverage (Coverage C)

Covers the contents of your home—furniture, electronics, appliances, clothing—if they’re damaged, destroyed, or stolen. It usually applies even if the loss happens away from home (e.g., a laptop stolen from your car).

- Liability Protection (Coverage E)

If someone is injured on your property or you accidentally damage someone else’s, this coverage helps pay for legal fees, medical expenses, and damages. It’s essential for protecting your financial future.

- Loss of Use/Additional Living Expenses (Coverage D)

If your home becomes uninhabitable due to a covered event, this helps pay for temporary housing, meals, and other living expenses while repairs are made. Your InsureOne agent will explain your coverage to you and help you decide what is more important.

What Is the Most Common Type of Home Purchased in Auburn?

In Auburn, single‑family detached homes are the clear frontrunner—accounting for approximately 48% of all housing units in the city. These are typically 3–4 bedroom homes that appeal to families, professionals, and faculty associated with Auburn University.

These detached homes dominate Auburn’s housing mix, while large apartment complexes or high-rise units make up roughly 32%, and duplexes or smaller multi-unit buildings account for about 9%. Attached townhomes and rowhouses comprise a much smaller share, under 8%.

What’s more, more than 50% of homes in Auburn have been built since 2000, giving many neighborhoods a newer, suburban feel.

Why it matters for insurance: Single-family detached homes are the most frequently insured type in Auburn. Because they form the majority of homeowners’ policies, insurers are well-versed in risk assessment—making it easier to compare quotes, understand typical replacement-cost values, and navigate coverage nuances such as wind or hail deductibles.

If you’re evaluating coverage for a detached home, this is the most common housing profile in Auburn and a good benchmark for comparison.

Which Common Natural Disasters Are Covered by Home Insurance in Auburn?

Living in Auburn means enjoying scenic neighborhoods and a vibrant college-town atmosphere—but it also means preparing for the unpredictable Alabama weather. Fortunately, a standard homeowners insurance policy (also called an HO-3 policy) offers protection against many common natural disasters Auburn residents may face.

Typically covered disasters common to this area include:

- Tornadoes and windstorms – Alabama ranks among the top states for tornado activity. If strong winds or flying debris damage your home, it’s typically covered.

- Hailstorms – Often part of spring and summer thunderstorms, hail damage to roofs, siding, or windows is usually included in standard coverage.

- Lightning strikes – Whether it causes fire or power surges, lightning-related damage is generally protected.

- Fires – Wildfires and house fires from natural or accidental causes are covered under most policies.

Understanding which disasters are covered—and which require extra protection—can help you build a policy that truly safeguards your home and peace of mind.

Get the Best Homeowners Insurance in Auburn with InsureOne Today

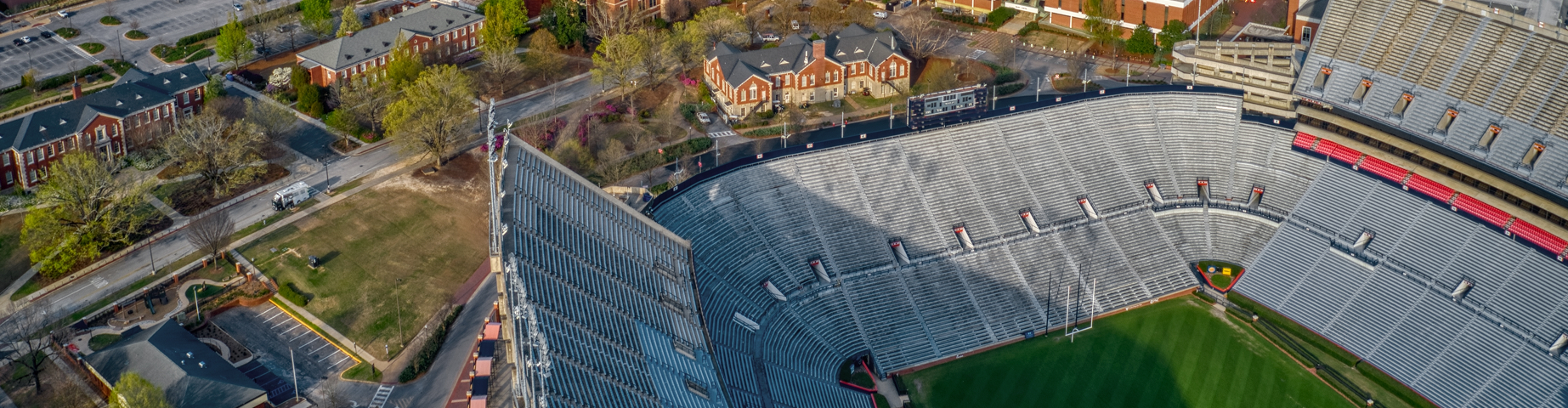

Full-time residents of Auburn – and seasonal and temporary college students – have much to enjoy about this little corner of paradise. Great food options top most lists and there is Chewacla State Park for some outdoors activities, such as hiking. Those who enjoy nature can visit Kreher Preserve & Nature Center or catch a game at Plainsman Park.

Due to its inland location, residents here enjoy lower home insurance prices. Check in you’re your neighborhood InsureOne agent for the best coverage options. Give us a call at (800) 836-2240, stop by one of our neighborhood locations or get a fast quote for homeowners insurance online.