Tennessee Homeowners Insurance Quotes

Everything You Need to Know about Home Insurance in Tennessee

Tennessee offers a diverse range of attractions and experiences for residents and tourists alike. From the music scene in Nashville to the historic landmarks in Memphis, there is always something exciting happening in the state.

For those who love the outdoors, Tennessee is a paradise with its natural beauty. Great Smoky Mountains National Park provides opportunities for hiking, camping, and wildlife spotting. Additionally, the state is home to beautiful lakes and rivers, perfect for water activities like boating and fishing.

While enjoying all that the Volunteer State has to offer, it’s important to protect your house with a reliable insurance policy. InsureOne understands the importance of safeguarding your property and offers the best homeowners insurance at competitive prices, so you can have peace of mind knowing that your home is protected while you explore the wonders of Tennessee.

How Much Does Homeowners Insurance Cost in TN?

In Tennessee, the average cost of homeowners insurance is $2,095 per year, equivalent to $175 per month, for a policy with $300,000 in dwelling coverage. Comparatively, this exceeds the national average cost of $1,754 per year, indicating that insurance in Tennessee tends to be pricier.

It is important to note that home insurance costs in Tennessee can fluctuate significantly depending on your location. For instance, residents of Memphis typically pay $2,197 per year for coverage, whereas those in Brentwood enjoy a lower average cost of just $1,745 per year.

How Do Home Insurance Deductibles Affect Rates in Tennessee?

Understanding how deductibles can impact your home insurance rates is a critical aspect of securing coverage. A deductible is the amount you must pay out of pocket before your insurance kicks in and covers the rest of your claim.

Generally, choosing a higher deductible can lead to lower premiums as you are effectively assuming more financial responsibility in the event of a claim. However, finding the right balance is crucial. You should select a deductible that not only helps you save money on premiums but is also feasible for you to pay if you need to file a claim.

For instance, suppose you have a deductible of $1,000 and your home incurs $3,000 in damages. In that case, you will need to pay the initial $1,000, and your insurance will cover the remaining $2,000. You should choose a deductible that aligns with your financial situation to avoid any unexpected financial strain in the event of a claim.

At InsureOne, our experienced agents can help you find the optimal deductible that meets your coverage needs and budget requirements.

Compare Home Insurance Rates by Coverage Levels in TN

Below is a detailed table showcasing the average yearly premium rates in Tennessee for four different levels of dwelling coverage.

When selecting your coverage level, it is crucial to carefully assess your unique needs. Consider factors such as the value of your home, potential risks, and your budget limitations to make a well-informed decision. We also recommend reading our article “Welcome Home: Everything a New Homeowner Needs to Know About Home Insurance”.

| Dwelling Coverage (Tennessee) | Average Annual Insurance Cost |

|---|---|

| $100,000 | $931 |

| $200,000 | $1,459 |

| $250,000 | $1,697 |

| $400,000 | $2,539 |

Find top-rated home insurance from national carriers at affordable prices. Let InsureOne agents provide excellent customer service and flexible plans tailored to your needs.

Is Home Insurance Tax Deductible in Tennessee?

While the cost of home insurance in Tennessee is generally not eligible for tax deductions, there are certain circumstances where you may have opportunities to deduct associated expenses from your income tax. One such example is if you use your home as an office or rental space, you may qualify for deductions related to those specific uses.

It is essential to note that tax laws can be complex and subject to frequent updates. Therefore, if you have any tax-related inquiries, it is highly recommended to seek professional advice from experts who can provide personalized guidance based on your individual situation.

Does Tennessee Have the 80% Homeowners Insurance Rule?

It’s crucial to note that most insurance providers require homeowners to purchase dwelling coverage worth at least 80% of their home’s replacement cost to guarantee full coverage. This means if your home has a replacement value of $275,000, you would need insurance coverage of at least $220,000 to avoid your carrier not paying the total amount of your approved claim.

However, many homeowners fail to adjust their coverage to take into account inflation and home improvements, which can impact the overall replacement cost. As a result, they may be surprised after a disaster or loss when the insurance company doesn’t fully cover the cost of replacing their home.

It’s essential to maintain at least 80% of the replacement cost of your home for appropriate reimbursement in case of a claim. If this requirement isn’t met, the insurance company might only pay the difference between 80% of the replacement cost and the coverage amount you purchased. To stay well-informed, don’t forget to read “7 Most Common Mistakes That Keep Your Home Insurance From Paying Out“.

Bundling Home and Auto Insurance in Tennessee

Bundling is a cost-effective approach where homeowners obtain both home and auto insurance from the same provider. This method comes with numerous advantages, including increased convenience, potential cost savings, and simplified management of policies since one insurer handles both home and car coverage.

In Tennessee, insurers offer an annual discount of $596, which is an 18% reduction in total premium, if you bundle policies. Furthermore, bundling provides more comprehensive protection for your home and vehicle, and insurance companies often provide extra features or benefits to policyholders who opt for bundled insurance.

To take advantage of these perks, it’s advisable to compare quotes and consult with insurance agents who can provide personalized bundling options that suit your specific requirements. Moreover, you can use the 9 Tips to Save on Homeowners Insurance to further increase your savings.

What Weather Events Affect Home Insurance Costs in Tennessee?

When it comes to home insurance in Tennessee, it’s important to consider the coverage for specific weather events that can impact your home.

In this state, tornadoes are a common occurrence and can cause extensive damage to homes. Review your home insurance policy to ensure it covers damage caused by strong tornadic winds, such as ripped shingles or fallen trees. It’s worth noting that while most standard homeowners policies cover wind damage, there may be a separate deductible for wind or hail damage. Similarly, make sure you are prepared by following the .

Flooding is another significant risk for homeowners, particularly for those residing in low-lying areas or near bodies of water. Homeowners insurance typically does not cover water damage caused by flooding, so it is advisable to purchase additional flood insurance if you are at risk. To assess the likelihood of flooding, you can use resources like the Federal Emergency Management Agency’s flood maps or the RiskFactor.com website.

Sinkholes are prevalent in Tennessee, especially in the central and eastern regions, due to landscape covering limestone and composed of water-soluble rocks. Unfortunately, most standard homeowners insurance policies do not cover damage caused by sinkholes. However, Tennessee insurance companies are required by law to offer sinkhole coverage as an option to homeowners.

What are the Different Types of Home Insurance?

The most common types of houses in Tennessee are single family homes and condominiums. Single family homes are standalone structures designed for one family and make up over 70% of all homes in Tennessee. Condominiums, on the other hand, are multi-unit buildings where each unit is individually owned.

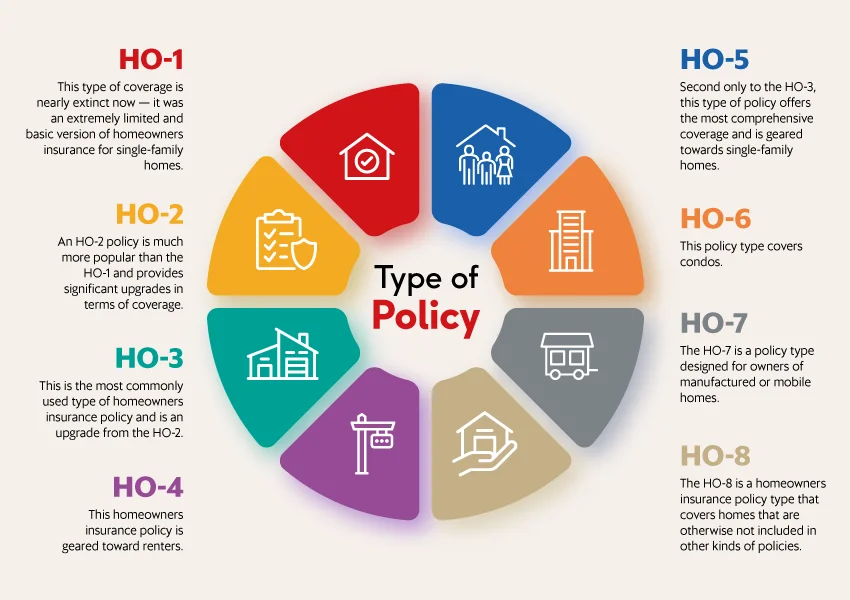

Other classes of homes popular in Tennessee include townhouses, apartments, and mobile homes. Each of these housing types has specific insurance needs, and there are 8 available to cater to the different classes of homes.

If you are uncertain about the specific type of home insurance coverage you need, we highly recommend reading “Everything a New Homeowner Needs to Know About Home Insurance” and seeking guidance from a specialized agent. They can assess your situation and provide tailored recommendations to ensure your home is adequately protected.

What is the Most Common Homeowners Insurance in Tennessee?

The HO-3 policy, also referred to as the Special Form policy, is a widely favored option by homeowners in Tennessee. This comprehensive policy offers extensive coverage against a variety of risks and hazards that could potentially cause damage to your home and personal belongings.

One of the key features of the HO-3 policy is that it provides coverage for your home at its replacement value. This means that in the unfortunate event of a total loss, the insurance will cover the cost of rebuilding your home, ensuring you can recover without any financial burden.

Additionally, the HO-3 policy also includes coverage for personal belongings. This means that not only is your home protected, but your valuable possessions are also covered in the event of damage or loss.

Furthermore, the HO-3 policy includes liability protection. This means that if someone is injured on your property and files a lawsuit against you, the policy will assist in covering legal expenses and potential settlement costs.

Get the Best Homeowners Insurance in Tennessee Today

At InsureOne, we take pride in offering outstanding homeowners insurance coverage for Tennessee residents. Our team of dedicated professionals goes above and beyond to conduct extensive research and customize the best and most affordable solutions that meet your unique requirements.

You can easily get in touch with us by phone at (800) 836-2240, where our friendly representatives are ready to assist you. You can also obtain a quick and convenient home insurance quote through our online platform. If you prefer a more personal experience, feel free to visit one of our conveniently located offices.