New York Homeowners Insurance Quotes

Everything You Need to Know about Home Insurance in New York

New York State is the fourth most populated state in the nation – and it’s easy to see why people flock here. In the “North Country” are the famous Adirondack Mountains and an international border with our friendly neighbor, Canada. There are two Great Lakes (Lake Ontario and Lake Erie) on the west and moving towards the south and east, outdoor enthusiasts will encounter the Catskill Mountains. At the southern tip, lies New York City (the most populous city in the U.S.) and Long Island (the most populous island in the U.S.).

Although many people associate the Empire State with its most famous city, New York City, most of the state’s geographic area consists of meadows, forests, rivers, farms, mountains and lakes. The state includes famous waterways, such as the Hudson River, Niagara River (and Falls) and the Saint Lawrence River. Long, cold winters and sultry, hot summers are the norm for a large part of this state.

Although many visitors travel to this northern state to enjoy camping, hiking and water sports in the vast outdoor areas, New York City has three of the world’s 10 most visited tourist spots: Times Square, Central Park and Grand Central Terminal. Niagara Falls is also on that list.

There are more than 200 colleges and universities, including two Ivy League institutes, Columbia and Cornell. New York City is considered a cultural, financial and media mecca, although there are several other cities in this all-encompassing state that deserve their own accolades: Finger Lakes (pristine lakes and more than 100 vineyards and wineries); The Hamptons (white, sandy beaches and amazing seafood); and Long Island (many small towns, sandy beaches and more). Whether you live in upstate or downstate New York, you need the best hners insurance at the best price. InsureOne agents can do the work for you, so you have more time to enjoy everything the Knickerbocker state has to offer!

How Much Does Homeowners Insurance Cost in New York State?

As with all insurance products, the amount you’ll pay depends on a variety of factors. For $250,000 in dwelling coverage, New Yorkers pay an average of $1,500 annually.

The average cost in the U.S. for dwelling coverage limits of $200,000 to $750,000 is between $1,000 and $3,000 annually. The actual average in that range is around $1,800 per year. So, on average, New Yorkers are paying slightly less than the national average.

Home insurance premiums depend on factors such as the amount necessary to rebuild the home, the type of home, the location and much more.

Does New York Have the 80% Homeowners Insurance Rule?

Most insurance companies use the 80/20 rule to determine how much they will pay out in the event of a claim. If your home is insured for less than 80% of its replacement value, you may receive a smaller reimbursement than the replacement value on your policy.

For example, a home with a replacement cost of $500,000 should be covered for at least $400,000 (80% of $500,000). If the home is insured for less than that, the insurer will only pay out a portion of the minimum coverage purchased. Remember, if you make capital improvements to your home, you’ll need to increase your coverage amount to 80% or higher of the replacement cost.

How Do Home Insurance Deductibles Affect Rates in New York State?

One thing that determines your home insurance premium amount is the deductible you choose. A higher deductible means a lower premium. That’s because you are assuming more of the financial burden in the event of a claim. Here’s how it works.

If you have a home insurance policy worth $300,000 in dwelling coverage and you choose a $500 deductible, it means your insurer will have to pay $299,500. If, on the other hand, your deductible is set at $1,000, your insurer will need to pay $299,000. It doesn’t sound like much of a difference at this level, but you can lower your premium this way.

Compare Home Insurance Rates by Coverage Levels in New York State

One of the most important factors determining your premium amount is how much dwelling coverage your policy is worth. This number represents how much it will cost to rebuild your home in the event of a total loss. It’s best to be completely honest about this number; you don’t want to need it and not have it. Here are some average annual costs for New Yorkers based on the value of their home.

| Dwelling Coverage (New York) | Average Annual Insurance Cost |

|---|---|

| $100,000 | $517 |

| $200,000 | $815 |

| $300,000 | $1,114 |

| $400,000 | $1,430 |

| $500,000 | $1,761 |

At InsureOne, we can help you find the best home protection at the best price. We’ll shop around for you and provide you with the top options so you can choose.

Is Home Insurance Tax Deductible in New York State?

Unfortunately, you cannot write off your homeowner’s insurance on your taxes if your home is used solely for a personal residence. There are a few situations where this may not apply, including:

- Working from home and using a room as a home office

- If you’ve had an insurance claim denied or only partially covered, you may be able to take a deduction for a casualty loss.

Bundling Home and Auto Insurance in New York

Besides increasing your deductible, there are other ways to save money on your policy. For example, you can have your home insurance and auto insurance (or any other policy) together with the same company. This is called bundling and it will typically net you about 15% off your premium.

There are other discounts you may qualify for, so check in with your neighborhood InsureOne agent to get the scoop.

What are the Different Types of Home Insurance?

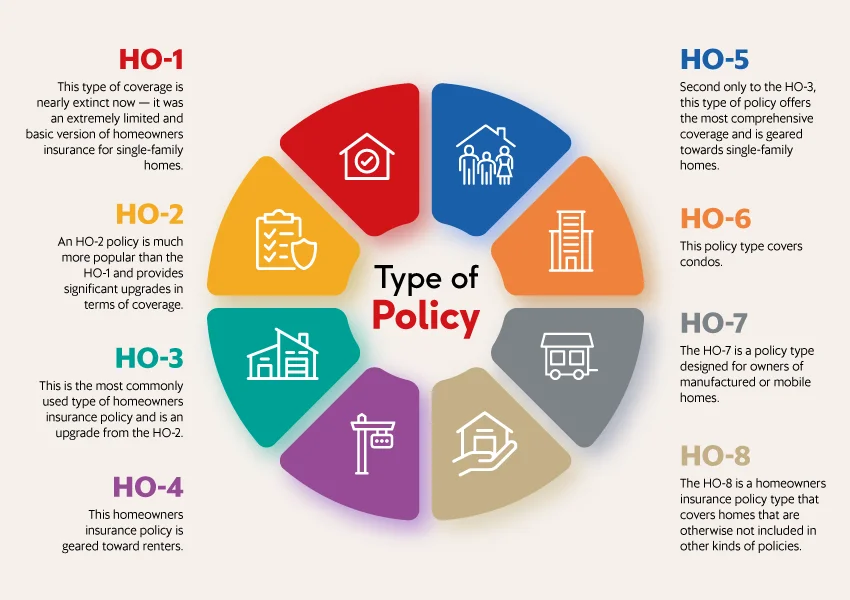

There are 8 different types of homeowners insurance policies and they all provide coverage for that special place you call home – whether it’s a split-level ranch or a condo in the Adirondacks.

Purchasing the correct type of home insurance is vital. Let an InsureOne professional guide you through the process.

What Weather Events Affect Home Insurance Costs in New York?

Many people still remember Hurricane Sandy and the devastation it wreaked on the state of New York in 2012. Besides the enormous toll on residents, insurance companies forked out almost $19 billion in New York City and a total of $32 billion for the entire state. Besides wind damage, heavy rain and storm surge caused untold destruction. Sandy wasn’t even still a hurricane by the time it reached New York, but the damage was still enormous.

Fortunately, hurricane damage at this level is rare. More common weather issues in New York include thunderstorms with lightning, high winds and heavy rain, plus nor’easters which can pack a punch of strong winds, hail, blizzards and flooding.

What is the Most Common Homeowners Insurance in New York?

Where you live will have a lot to do with the type of homeowners insurance you choose. Those who live near the coast or rivers that may flood will certainly want to make sure they have provisions for wind and flood damage. Most insurers do not offer coverage for flooding, but it can be purchased from the federal government at an average cost of $1,250 annually.

There are many historic homes located throughout New York, so homeowners with an aging beauty may consider HO-8, since the value of the home and replacement cost may differ wildly. In addition, your historic charmer may include unique features such as original floors, stained glass and other details. Replacing these items may not be easy so ensure you have the right coverage before you start renovations.

Get the Best Homeowners Insurance in New York Today

At InsureOne, it’s our mission to help you find the home insurance that best fits your needs for the best price. Insurance is not a one-size-fits-all proposition. You deserve undivided attention so you can the best plan. We’ll listen to your needs and budget and research options for you so you can spend time doing things you love. At our one-stop shop, we’ll present you with competitive options tailored specifically to you. Reach out to us today by phone at (800) 836-2240 or find a quick home insurance quote online. You are also welcome to stop by one of our convenient New York locations.