Arkansas Homeowners Insurance Quotes

Everything You Need to Know about Home Insurance in Arkansas

Arkansas is a state in the southern region of the United States known for its diverse landscapes and rich history. With rolling hills, forests, and rivers, the region offers a tranquil setting for outdoor enthusiasts and has earned the nickname the Natural State.

Visitors and residents alike can explore national parks in Arkansas such as the Ozark National Forest and Hot Springs National Park. These parks offer ideal opportunities for hiking, camping, and appreciating nature. Arkansas is also home to historical sites like the Little Rock Central High School, offering insights into the Civil Rights Movement. Additionally, vibrant cities like Little Rock and Bentonville provide opportunities to explore art, culture, and local cuisine.

Whether you’re moving to Arkansas or already here, protecting your assets with homeowners insurance is crucial. Let an InsureOne agent find the right coverage for you, so you can fully enjoy Arkansas’s attractions.

How Much Does Homeowners Insurance Cost in Arkansas?

The cost of homeowners insurance in Arkansas is an important factor to consider. On average, it amounts to $2,838 per year or $237 per month. This is around 62% higher than the national average of $1,754. However, it is crucial not to let these higher costs deter you, as there are ways to save on home insurance and still obtain the necessary coverage.

Arkansas may not be the most dangerous state when it comes to severe weather and natural disasters, but it is still susceptible to the elements throughout all four seasons. Spring and summer bring the potential for severe tornadoes and wildfires, making homeowners insurance a necessary investment. By finding affordable coverage, you can protect your assets and have peace of mind in Arkansas’s ever-changing climate.

How Do Home Insurance Deductibles Affect Rates in the Natural State?

The choice of your deductible amount can have a considerable impact on your insurance premium, especially given the environmental factors in Arkansas. Opting for a higher deductible may allow you to lower your premium. By taking on more responsibility for approved claims, like weather-related damages, your insurance company may offer you a reduced cost as a result.

For example, let’s say your deductible is set at $2,000. If a severe tornado occurs in Arkansas and causes damage to your roof, your insurance company would only need to cover the expenses that exceed your deductible. Depending on the type of roofing material and the size of your roof, homeowners in Arkansas typically pay

between $4,340 and $11,395 for a full roof replacement. In comparison, the average cost to repair a roof currently averages $417. By choosing a higher deductible, you are assisting your insurance company in saving a significant amount, specifically in relation to the potential environmental risks in Arkansas. By getting a better understanding of how home insurance deductibles work, you can plan ways to save money on your policy every year.

Comparing Home Insurance Rates by Coverage Levels in Arkansas

The dwelling coverage limit is generally set to match the replacement cost value (RCV) of a home. The RCV represents the estimated expenses involved in rebuilding or restoring a home to its original condition. Several factors, including the age of the home and the materials used in its construction, are taken into consideration to determine this value.

To give you an idea of the average annual costs for homeowners in Arkansas, here are some examples based on different coverage amounts.

| Dwelling Coverage (Arkansas) | Average Annual Insurance Cost |

|---|---|

| $100,000 | $1,385 |

| $200,000 | $2,112 |

| $300,000 | $2,838 |

| $400,000 | $3,594 |

| $500,000 | $4,439 |

At InsureOne, we can help you find the best home protection at the best price. We’ll shop around for you and provide you with the top options so you can choose.

Is Home Insurance Tax Deductible in Arkansas?

In most cases in Arkansas, it is not possible to deduct homeowner’s insurance on your taxes. However, in specific situations like having a home office or experiencing a denied damage claim, there may be a possibility of taking a deduction. It is advisable to consult with a certified tax professional to determine if you qualify for any deductions on your homeowner’s policy. They can provide personalized guidance and help you understand the potential deductions available to you based on your specific circumstances.

Does Arkansas Have the 80% Homeowners Insurance Rule?

Insurance companies typically follow the 80/20 rule when determining claim payouts. According to this rule, your policy limit should be at least 80% of your home’s replacement cost coverage for the insurer to fully cover any claims.

To ensure that you maintain adequate coverage, it is important to regularly review and adjust your policy as necessary. This includes considering any significant home improvements and accounting for inflation. If the cost of materials, such as lumber, increases, it will also affect the replacement cost of your home. Get in touch with your InsureOne agent to ensure that you have the appropriate amount of coverage for your needs.

Is Bundling Home and Auto Insurance in Arkansas a Good Idea?

In Arkansas, it’s a savvy move to bundle multiple policies with the same insurance company. This shows your loyalty and trust in letting them handle all your insurance needs. And the best part? You can usually snag a discount of 15% to 25% on your premium.

In addition, there are other discounts available, such as being a current or former military member or first responder, and more. So, make sure to ask your local insurance agent to find out how much you could potentially save.

What Weather Events Affect Home Insurance Costs in Arkansas?

In Arkansas, several weather events can have a significant impact on home insurance costs. The state is no stranger to extreme weather conditions, which can lead to potential damages and losses for homeowners. Here are some weather events that commonly affect home insurance costs in Arkansas:

- Severe Storms: Arkansas experiences frequent thunderstorms, often accompanied by high winds, heavy rainfall, and lightning strikes. These storms can cause damage to roofs, windows, and other structural components of the home. Insurance policies usually cover storm-related damages, but frequent claims can result in increased insurance premiums.

- Tornadoes: Arkansas is situated in “Tornado Alley,” an area prone to tornadic activity. Tornadoes can cause destruction to homes, including total or partial damage.

- Hailstorms: Hailstorms can cause extensive damage to roofs, siding, and windows. The insurance coverage for hail damage may vary based on your policy. If your home is in an area prone to hailstorms, your insurance premiums may be higher to account for the increased risk.

- Flash Floods: Arkansas is susceptible to flash floods, especially in areas near rivers and low-lying regions. Flood damage is not typically covered by standard home insurance policies. Homeowners in flood-prone areas may need to purchase separate flood insurance or endorse their policy to include flood coverage.

- Winter Storms: While Arkansas generally has milder winters compared to northern states, there can still be severe winter storms with freezing temperatures, ice, and snow. These conditions can lead to burst pipes, roof collapses, or other damage to homes. Insurers may factor in the risk of winter-related damage when determining premiums.

It’s essential for homeowners in Arkansas to review their insurance policies to ensure they have adequate coverage for these weather-related events. Additionally, taking preventive measures like maintaining the home’s structure, installing storm shutters, and reinforcing roofs can help reduce the risk of damage and potentially lower insurance costs.

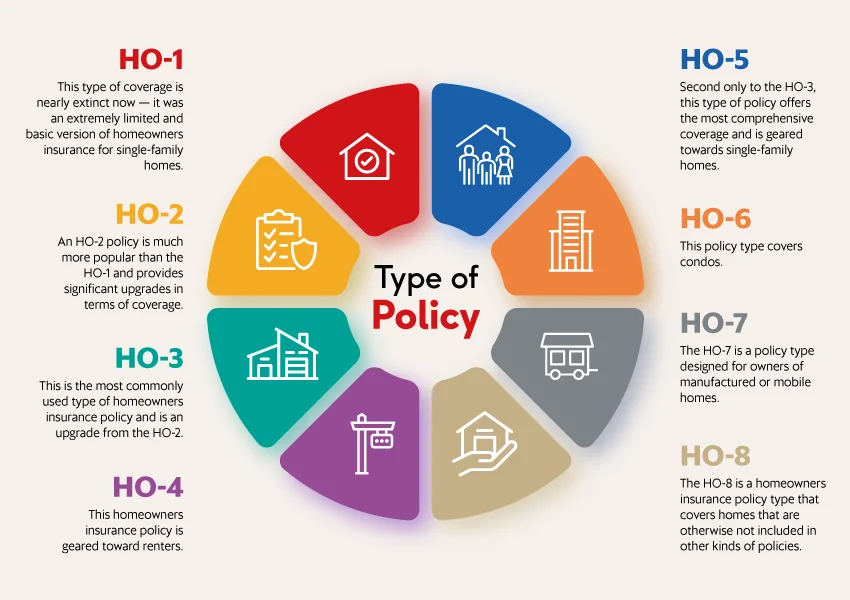

What are the Different Types of Home Insurance?

There are different types of homeowners insurance policies available that provide coverage for the common types of homes in Arkansas, whether it’s a traditional single-family house, a ranch-style home, or a townhome in the city.

It is crucial to purchase the correct type of home insurance to ensure adequate coverage. Let an InsureOne professional guide you through the process. They can provide the necessary expertise to help you select the right policy based on the type of home you own in this state.

What is the Most Common Homeowners Insurance in Arkansas?

In Arkansas, the most prevalent homeowners insurance policy is the HO-3 policy. This option usually offers replacement cost coverage for your home and other structures, as well as actual cash value coverage for personal property.

Get the Best Homeowners Insurance in Arkansas Today

Experience the priority we give to you at InsureOne. Discover tailored and competitive options for your home insurance in Arkansas. Call (800) 836-2240 or receive a quick home insurance quote online. Alternatively, visit one of our convenient Arkansas locations.

Allow us to handle your home insurance worries while you cherish valuable moments with your loved ones. Contact us today and get the friendly support you deserve!