Texas Homeowners Insurance Quotes

Everything You Need to Know about Home Insurance in Texas

Population wise, Texas has been growing by leaps and bounds in recent years. In the last decade, the population in the Lone Star State jumped 43%, which made it the fourth fastest growing state in the nation. Why is Texas such a draw to new residents and homeowners? More people are becoming Texans due to the cost of living, a growing job market and various and diverse places to recreate.

If you are coming from the north, Texas has a warm and mild climate and, in the southern half, only gets snow and freezing temperatures briefly, if at all. The coastal areas of Texas, like South Padre Island and Port Aransas, offer excellent fishing and sunny beaches. In the job market, more tech firms are setting up shop in Texas – particularly in Central Texas, where you’ll find Austin and its vibrant musical scene. There are a number of top universities, such as the University of Texas, and medical centers, like the Texas Medical Center in Houston, located in Texas – and there’s no state income tax!

If you plan to move to Texas or you already live here, you’ll need to find the best homeowners insurance at the best price. Let an InsureOne agent do the research for you, so you have more time to enjoy the many attractions the Lone Star State has to offer.

How Much Does Homeowners Insurance Cost in Texas?

The average cost for home coverage in Texas falls somewhere between $2,000 and $4,000 annually for a home valued at $250,000. Average costs in the nation are between $1,000 and $3,000, so Texas homeowners pay more for their policy.

This is because the state sees a wide variety of expensive home damage due to natural disasters such as hurricanes in the south, tornadoes in the north, and high winds, hail and flooding everywhere. Lately, wildfires have become more frequent and damaging (due to a severe and ongoing drought).

The cost of a premium varies widely from home to home and depends on many factors, such as location, type of home and the cost to rebuild.

How Do Home Insurance Deductibles Affect Rates in the Lone Star State?

The higher your deductible, the lower your premium. Changing your deductible is one way you can increase or decrease your rates. If you assume more of the financial burden of paying for a claim, your insurer is likely to reward you with a lower cost.

For example, if you set your deductible at $2,000, that’s $2,000 your carrier doesn’t have to pay if your roof blows off in a storm. The average cost of replacing a roof in Texas is between $7,000 and $12,000, so you’ll be saving your insurance company quite a bit by assuming a higher deductible.

If you want to learn more about how your deductible works, check out this article on home insurance deductibles.

Comparing Home Insurance Rates by Coverage Levels in Texas

Your dwelling coverage limit is usually the same as the replacement cost value (RCV). RCV is how much it will cost to build a new home or bring a home back to its original condition. Many factors go into determining this number, including the age of the home, what materials the home is made of and more. Here are some average annual costs for Texans based on the value of their home.

| Dwelling Coverage (Texas) | Average Annual Insurance Cost |

|---|---|

| $100,000 | $1,300 |

| $200,000 | $2,000 |

| $300,000 | $3,000 |

| $400,000 | $3,750 |

| $500,000 | $4,600 |

At InsureOne, we can help you find the best home protection at the best price. We’ll shop around for you and provide you with the top options so you can choose.

Is Home Insurance Tax Deductible in Texas?

Under most circumstances, you cannot write your off your homeowner’s insurance in Texas. In special situations, such as having a home office or having a claim for damage denied, you may be able to take a deduction. It’s always best to seek the advice of a certified tax professional to find out if you can deduct some or all of your homeowners policy.

Does Texas Have the 80% Homeowners Insurance Rule?

The 80/20 rule is used by most carriers to determine how much they will pay out in the event of a claim. What it means is you must have at least 80% of your home’s replacement cost coverage as your policy limit in order for your insurer to pay out the full coverage amount.

For example, you paid $275,000 for your home. You will need at the least $220,000 in insurance to meet the 80% rule so your insurer will fully cover any claims.

To stay at the right level of coverage, remember to adjust up to reflect any major home improvements, as well as inflation. If lumber prices go up, the cost to replace your home will too. Check with your InsureOne agent to find out how to ensure you are covered for the right amount.

Is Bundling Home and Auto Insurance in Texas a Good Idea?

Bundling two or more policies together with the same company is a great idea in the Lone Star State. For one thing, it shows your insurer you are going to stick around and let them handle your needs. Most of the time, you can see a 15%-25% decrease in the form of a discount on your premium.

Besides bundling, there are other discounts you may be able to take advantage of, such as driving less than 7,500 miles annually, being a former or current member of the military or a first responder and many more. Be sure and ask your neighborhood insurance agent to find out how much you can save.

What Weather Events Affect Home Insurance Costs in Texas?

Texans face a large variety of weather events that cause damage and may result in higher home insurance premium. Among the worst are hurricanes in the gulf, tornadoes in the panhandle and high winds, hail and flooding across the state.

Taking measures to reduce your risk can certainly help. For example, trim back growth around your home if you live in an area prone to wildfires.

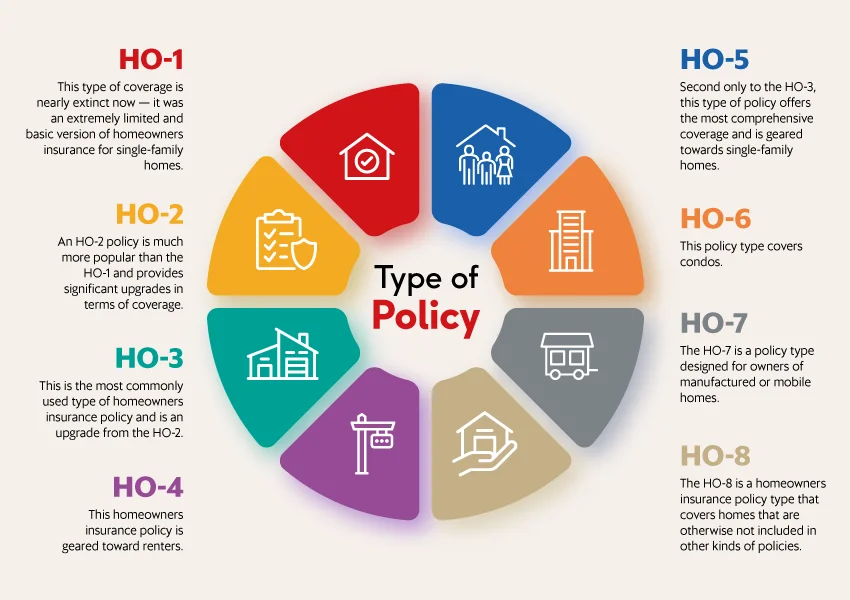

What are the Different Types of Home Insurance?

There are different types of homeowners insurance policies and they all provide coverage for that special place you call home – whether it’s a ranch in the hill country or a condo at the beach.

Purchasing the correct type of home insurance is vital. Let an InsureOne professional guide you through the process.

What is the Most Common Homeowners Insurance in Texas?

Most homeowners in Texas opt for HO-3 coverage. This type of policy covers your home and belongings, offers liability and medical payments and will pay for living expenses if you are not able to live in your home due to a covered claim.

Where you live in Texas may affect the things you’ll want to insure against. For example, those who live at the coast will insure for different perils than those who live in the hill country. Although the Texas hill country does see flooding and other damages from thunderstorms, it isn’t as likely to see a hurricane or tornado as other parts of the Lone Star State.

If you live in an area prone to flooding, you may want to explore flood coverage, which you can get through the federal government.

Get the Best Homeowners Insurance in Texas Today

At InsureOne, our agents are here to help you find the home insurance that best fits your needs for the best price. You deserve the best plan for your specific situation. Our expert agents will listen to your needs and budget and research options for you so you can spend time doing things you love. At our one-stop shop, we’ll present you with competitive options tailored specifically to you.

Reach out to us today by phone at (800) 836-2240 or find a quick home insurance quote online. You are also welcome to stop by one of our convenient Texas locations.