Massachusetts Homeowners Insurance Quotes

Everything You Need to Know about Home Insurance in Massachusetts

Massachusetts is widely praised for its history, culture and growing job market. Whether you’re drawn to the bustling streets of Boston or the coastal towns, the state boasts a diverse range of cities and towns, each with its own unique character- making it a great place to live, work and raise a family.

However, what truly sets the Bay State apart is its strong education system. The state houses some of the top colleges and universities in the country like Harvard University and the University of Massachusetts. In addition to its educational prowess, Massachusetts prioritizes the well-being of its residents through high-quality healthcare services.

Still, in this state, safeguarding your home is essential. With comprehensive coverage options and affordable rates, InsureOne offers you peace of mind with the best homeowners insurance.

How Much Does Homeowners Insurance Cost in Massachusetts?

Massachusetts, as the most populous state in New England, boasts a diverse range of attractions and opportunities for residents of all interests. In addition, homeowners in Massachusetts enjoy the added advantage of below-average home insurance rates compared to the national average.

With an average cost of $1,275 per year or $106 per month, Massachusetts offers homeowners 27% savings over the national average of $1,754 per year for $300,000 in dwelling coverage.

Does Massachusetts Have the 80% Homeowners Insurance Rule?

When it comes to determining the payout for an approved insurance claim, insurance carriers typically follow the 80/20 rule. According to this rule, policyholders are required to maintain dwelling coverage that is at least 80% of the replacement cost value (RCV) of their home, as stated in their policy contract.

For instance, if the estimated replacement cost value (RCV) of your home is $450,000, your dwelling coverage should be no less than $360,000 (80% of $450,000). Failing to maintain sufficient coverage may result in incomplete reimbursement from your insurer in case of a claim.

It’s crucial to keep in mind that the replacement cost value (RCV) of your home can be influenced by home improvements and inflation, which may impact overall replacement costs. Therefore, regular communication with your insurance agent is vital to ensure you have the appropriate level of coverage that accurately reflects the RCV of your home.

How Do Home Insurance Deductibles Affect Rates in Massachusetts?

When it comes to securing home insurance in Massachusetts, it’s essential to understand how deductibles impact insurance rates. A deductible is the initial amount you must pay before your insurance coverage kicks in.

Typically, opting for a higher deductible leads to lower premiums since you assume more financial responsibility in the event of a claim. However, finding the right balance is crucial. You need to choose a deductible that not only saves you money on premiums but also remains affordable to pay out of pocket if necessary.

By working closely with knowledgeable InsureOne agents, you can discover the perfect deductible that aligns with your budget and provides adequate coverage for your home.

Compare Home Insurance Rates by Coverage Levels in MA

Look at the table below for a detailed breakdown of the average annual premium rates for five distinct levels of dwelling coverage in Massachusetts. These coverage options safeguard your home against structural damage.

| Dwelling Coverage (Missouri) | Average Annual Insurance Cost |

|---|---|

| $100,000 | $663 |

| $200,000 | $979 |

| $300,000 | $1,275 |

| $400,000 | $1,599 |

| $500,000 | $1,945 |

Find top-rated home insurance from national carriers at affordable prices. Let InsureOne agents provide excellent customer service and flexible plans tailored to your needs.

Is Home Insurance Tax Deductible in Massachusetts?

Although the cost of home insurance in Massachusetts is generally not tax-deductible, there are specific scenarios where related expenses may qualify for income tax deductions. For example, if you utilize your home as a home office or rental space, you might be eligible for deductions related to those specific uses.

However, it’s crucial to remember that tax laws are intricate and subject to changes. Therefore, if you have any inquiries regarding taxes, it is highly recommended that you consult with professionals who can offer customized advice based on your individual circumstances. Their expertise will help ensure you navigate the complexities of tax laws accurately.

Bundling Home and Auto Insurance in the Bay State

Bundling is the term used when a person purchases two or more policies, such as home and auto insurance, from the same company. This option provides several advantages, including greater convenience, potential cost savings, and easier policy management. By using one insurer for both car and home policies, you can experience more streamlined processes.

In Massachusetts, bundling insurance policies often results in an annual discount of $300, akin to a 10% reduction in the overall premium. Furthermore, opting for bundled insurance enables you to benefit from more comprehensive protection for your home and vehicle. Typically, insurance companies provide additional features or benefits to policyholders who choose bundled insurance.

Seek the guidance of a knowledgeable insurance agent who can help you navigate different coverage options, discounts, and tips to save on homeowners insurance.

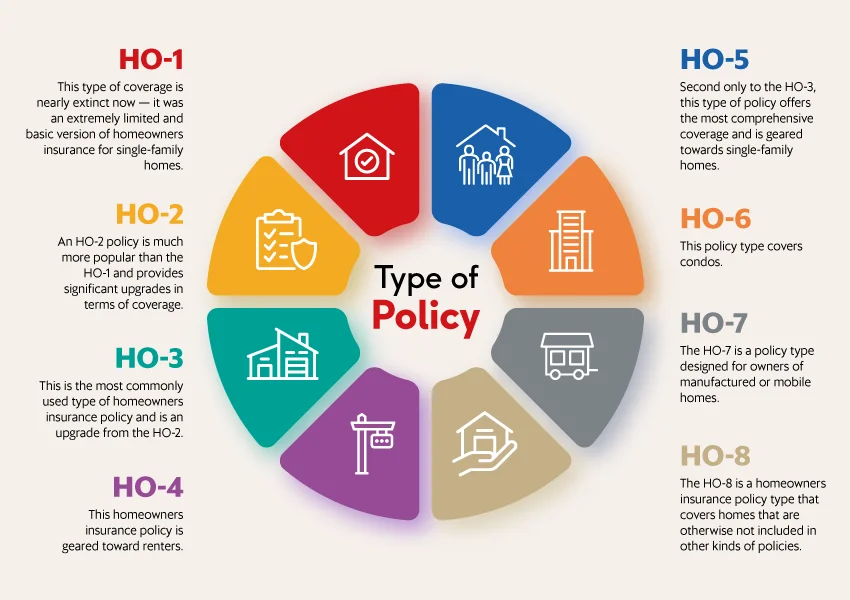

What are the Different Types of Home Insurance?

Massachusetts has a diverse range of homes, from the charming Craftsman to medieval Tudors. Each class of home has its own unique style and features that should be taken into consideration when selecting a type of home insurance. Some of the most common residential properties in the Cradle of Liberty are:

- Three-decker: A type of multi-family housing specific to Massachusetts, primarily found in the Boston area. These homes have three floors, with one apartment per floor, and often have high ceilings, hardwood floors, and ornate exterior elements such as bay windows. A landlord insurance or HO-3 policy, is recommended for three-decker homes.

- Cape Cod: A popular and well-loved house style throughout the US, characterized by symmetrical design, large chimney, steep pitched roof, and open floor plan. Cedar shingles, brick, stucco, or stone exteriors are also typical of the Cape Cod style. A standard homeowner’s insurance policy (HO-3) is generally suitable for Cape Cod-style homes.

- Colonial: Among the oldest home styles in the US and characterized by two-story construction, sloped gable or gambrel roof, and large interior fireplace. Exteriors of Colonial homes often have stone, wood, or brick facades with symmetrical windows. To adequately protect this type of home, the most recommended options are an HO-5 or HO-8 policy. These two options provide broader coverage.

Remember to consult with an insurance agent to determine the best coverage for your specific type of home in Massachusetts.

What Weather Events Affect Home Insurance Costs in Massachusetts?

In Massachusetts, there are several weather events that can have an impact on home insurance costs. Typically, these events are associated with higher risks of property damage.

One significant weather event is winter storms, including heavy snowfall, ice storms, and freezing temperatures. These conditions can lead to damage caused by frozen pipes, ice dams, and collapsed roofs. As a result, insurance companies often account for these risks when determining premiums for homeowners here.

Other weather events that affect home insurance costs in Massachusetts are hurricanes and windstorms. Although Massachusetts is not in the primary hurricane zone, it can still experience the powerful effects of tropical storms . Wind damage, such as fallen trees, roof damage, and structural destruction, can lead to increased insurance rates.

Additionally, this region is susceptible to severe thunderstorms and lightning strikes. Lightning can cause electrical damage and fires, resulting in potential claims that impact insurance costs for homeowners.

Flood insurance is a crucial consideration for Massachusetts homeowners, as heavy rainfall and coastal areas make the state prone to flooding. Standard home insurance policies typically do not cover flood damage. Therefore, purchasing separate flood insurance is necessary to protect against this specific weather event.

Lastly, tornadoes, although relatively rare in Massachusetts, can cause significant damage when they occur. Insurance companies may adjust rates based on the risk of tornado-related damage.

What is the Most Common Homeowners Insurance in Massachusetts?

The Special Form policy, also known as HO-3, is the most commonly chosen insurance option for homeowners in Massachusetts. This policy provides comprehensive protection against a wide range of risks and hazards that may lead to damage to your home and personal belongings.

With the HO-3 policy, your home is insured based on its replacement value, ensuring that your insurance will cover the cost of rebuilding your home in the event of a total loss. It also includes coverage for personal liability, medical payments, and loss of use. In case of damage or loss, this policy may also cover the cost of repair or replacement for personal property, such as furniture, clothes, and electronics.

It is important to note that the HO-3 policy has certain limitations and exclusions, and homeowners may need additional coverage depending on their individual circumstances. For example, flood insurance is not included in the HO-3 policy and must be purchased separately.

Get the Best Homeowners Insurance in Massachusetts Today

Massachusetts is a state that has everything, and by living here, you deserve the best care and attention. At InsureOne, we understand the importance of providing top-notch customer service and high-quality home protection. We take the responsibility of researching the best options for you, ensuring that you receive the coverage that meets your unique needs and preferences. Whether you prefer to give us a call at (800) 836-2240, explore your options on our website or visit one of our conveniently located offices, we are here to assist you every step of the way.