Kansas Homeowners Insurance Quotes

Everything You Need to Know About Home Insurance in Kansas

Kansas, a state with a rich history, offers visitors a chance to delve into the past. The name “Kansas” comes from the Native American Kansa tribe, who once inhabited the region. Museums and historic sites throughout the state provide insights into events like Bleeding Kansas and the Civil War.

Cities like Wichita and Topeka showcase Kansas’ cultural scene with galleries and theaters. Nature lovers can appreciate the state’s unspoiled beauty at places like Tallgrass Prairie National Preserve and Quivira National Wildlife Refuge.

Kansas presents a range of experiences for everyone to explore its etymology, delve into its history, and enjoy its natural wonders. However, if you own a home here, you will need homeowners insurance to protect your assets from any risks. At InsureOne, we can help you find the best coverage options at affordable rates.

How Much Does Homeowners Insurance Cost in Kansas?

In Kansas, homeowners insurance costs an average of $2,981 per year or $248 per month. This is approximately 70% higher than the national average of $1,754.

Located in Tornado Alley, Kansas experiences a high frequency of these devastating weather events, making it one of the most tornado-prone states in the country. The state is also prone to strong storms and flooding. For residents living in high-risk flood zones, it is crucial to have comprehensive home insurance coverage, including additional flood insurance which can be purchased through the government.

Does Kansas Have the 80% Homeowners Insurance Rule?

Insurance companies typically follow the 80/20 rule, also known as the 80% rule. According to this rule, it is advisable to insure your home for a minimum of 80% of its total replacement value. It is important to keep this figure updated regularly to account for inflation and any renovations or additions made to your home.

Your insurance policy is likely to include a provision that allows the insurer to pay only a percentage of your claim if your coverage is less than 80% of the total replacement value.

For example, if your home has a replacement cost of $500,000, it should be insured for at least $400,000 (80% of $500,000). If your coverage falls below this threshold, the insurer will only cover a portion of the minimum coverage purchased. Remember that if you make significant improvements to your home, you will need to increase your coverage amount to 80% or higher of the replacement cost.

How to Find Home Insurance in Kansas

When searching for home insurance in Kansas, it is important to shop around and compare quotes from multiple providers. This will ensure that you are getting the best coverage at the most affordable price. Additionally, consider opting for a higher deductible, as this can lower your monthly premiums. However, it is crucial to ensure that you will be able to afford the deductible in the event of a claim.

Don’t forget to inquire about any potential discounts that you may be eligible for, such as those based on safety features or claim history. Moreover, it is essential to review your policy limits to ensure they are sufficient to cover the cost of rebuilding your home in case of a total loss.

Lastly, make it a habit to regularly review your insurance coverage to verify it still meets your needs, as your home and possessions may change over time.

By following these steps, you can effectively find the right home insurance policy for your requirements in Kansas.

How Do Home Insurance Deductibles Affect Rates in Kansas?

The deductible you choose greatly influences your insurance premium. If you want to lower your premium, one option is to raise your deductible. By increasing your deductible amount, you will have to pay more out of pocket when a claim is approved.

Many insurance companies offer incentives to customers who agree to shoulder a larger portion of the claim amount. Therefore, opting for a higher deductible could lead to a lower premium as a reward.

Compare Home Insurance Rates by Coverage Levels in Kansas

In the event of a complete loss, most homeowners insure their homes for a minimum of 80% of the total cost of replacement.

The table presented below displays the average yearly premium for different levels of dwelling coverage available in Kansas. This insurance coverage particularly targets addressing potential structural harm or loss of your residence.

| Dwelling Coverage (Kansas) | Average Annual Insurance Cost |

|---|---|

| $100,000 | $1,787 |

| $200,000 | $2,600 |

| $250,000 | $3,139 |

| $400,000 | $4,517 |

At InsureOne, we can help you find the best home protection at the best price. We’ll shop around for you and provide you with the top options so you can choose.

Is Home Insurance Tax Deductible in Kansas?

Although home insurance is generally not eligible for tax deductions, except in specific cases such as using your home for business purposes, you may be able to deduct certain expenses related to setting up and operating a home office.

Bundling Home and Auto Insurance in Kansas

In Kansas, as well as numerous other states, it is often a wise choice to combine your home and auto insurance policies for multiple benefits. These advantages include cost savings, convenience, simplified coverage, multi-policy discounts, potential loyalty rewards, and a smoother claims process.

How Does Home Composition Impact Insurance Rates?

The composition of a home plays a significant role in determining insurance rates in Kansas. Insurance companies consider various factors related to the construction materials used, as they can impact the home’s vulnerability to certain risks.

Homes built with materials that are more resistant to damage, such as brick or stone, tend to have lower insurance rates. This is because these materials are more durable and can withstand severe weather conditions, such as storms or hail, better than other materials like wood.

On the other hand, homes constructed with materials that are more prone to damage, such as wood, may have higher insurance rates. This is due to the increased risk of fire or other types of damage.

Additionally, the age of the home can also affect insurance rates. Older homes might have outdated electrical systems, plumbing, or other components that pose a higher risk of accidents or damage. As a result, insurance companies may charge higher premiums to account for these potential risks.

It is important to note that insurance rates can vary depending on the insurer and their underwriting guidelines. Therefore, it is always recommended to shop around and compare quotes from different insurance providers to find the best coverage and rates for your specific home composition.

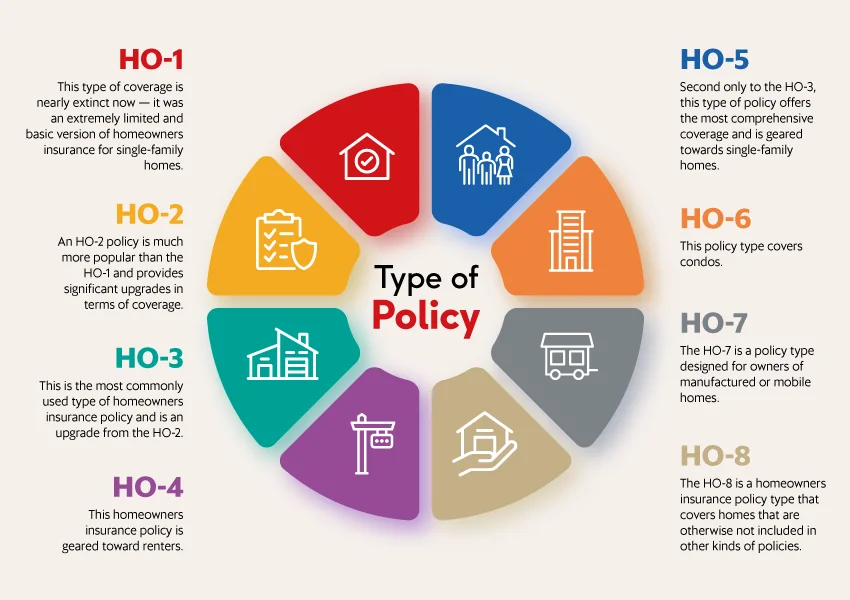

What are the Different Types of Home Insurance?

In Kansas, there are various types of homeowners insurance policies designed to protect your home. These policies are tailored to meet the specific needs of homeowners in the state, whether it’s a mid-century modern in Manhattan or a two-story in Shawnee.

Get the Best Homeowners Insurance in Kansas Today

As a resident of Kansas, ensuring your home is essential. At InsureOne, we specialize in simplifying the process of finding the perfect home insurance policy tailored to your unique needs. Simply let us know your requirements and we will present you with a range of flexible and customizable options. We strive to offer competitive solutions, allowing you to choose the best coverage for your Kansas home. Contact us today at (800) 836-2240 to speak with one of our experts or obtain a quick home insurance quote online. Feel free to visit one of our convenient locations as well. Don’t wait, secure your home with confidence today!