Washington Homeowners Insurance Quotes

Everything You Need to Know about Home Insurance in Washington

Washington is a state located in the Pacific Northwest region of the United States. Its name comes from George Washington, the first President of the United States. The state is known for its diverse cities, including Seattle, the largest city and economic center, followed by Spokane and Tacoma.

In terms of cuisine, this region is renowned for its fresh seafood offerings, thanks to the state’s proximity to the Pacific Ocean. Visitors can enjoy a variety of dishes such as grilled salmon, Dungeness crab, and Pacific oysters. The state is also famous for its locally produced wines, particularly from the Yakima Valley and Walla Walla regions.

Washington has a rich cultural scene, with numerous museums, theaters, and music venues. The Seattle Art Museum and the Museum of Pop Culture are popular attractions for art and culture enthusiasts. The state is also home to diverse Native American tribes, whose traditions and heritage can be experienced through various cultural events and exhibits.

One of the main tourist attractions in Washington is Olympic National Park, known for its diverse ecosystems, including rainforests, alpine meadows, and coastal areas. Additionally, the Space Needle in Seattle and the Washington State Capitol building in Olympia are iconic places that attract visitors from all over the world.

For many reasons, Washington is the perfect place to live. If you are a resident or thinking about moving here soon and buying a home, remember that you will need homeowners insurance. InsureOne offers the highest level of protection, ensuring that you have the best coverage at an affordable rate.

How Much Does Homeowners Insurance Cost in Washington State?

The average cost of homeowners insurance in Washington is $1,159 per year for a policy with $300,000 in dwelling coverage.

Although home insurance rates in Washington are approximately 34% lower than the national average, premiums have been increasing in recent years due to inflation and heightened wildfire damage.

Considering rising insurance costs and the increasing risk of natural disasters, it is crucial to compare quotes from multiple insurance companies. Doing so will help ensure you have adequate coverage for your home at the most competitive price available.

How Do Home Insurance Deductibles Affect Rates in Washington State?

One important factor that affects your home insurance premium is the choice of deductible. A higher deductible results in a lower premium since you are responsible for a larger portion of the claim costs. For instance, if you have a $1,000 deductible and make a claim of $10,000, you would pay the initial $1,000, while the insurance company covers the remaining $9,000.

In Washington, homeowners have various deductible options, typically ranging from $500 to $5,000 or even higher. Opting for a higher deductible can help reduce your insurance premium. However, it is crucial to ensure that you have enough financial resources to cover the deductible if a claim arises.

Compare Home Insurance Rates by Coverage Levels in Washington State

The table below provides average annual premiums in Washington for different levels of dwelling coverage. Generally, higher levels of dwelling coverage result in higher homeowners insurance rates.

| Dwelling Coverage (Washington) | Average Annual Insurance Cost |

| $100,000 | $596 |

| $200,000 | $868 |

| $300,000 | $1,159 |

| $400,000 | $1,523 |

| $500,000 | $1,856 |

At InsureOne, we can help you find the best home protection at the best price. We’ll shop around for you and provide you with the top options so you can choose.

Is Home Insurance Tax Deductible in Washington State?

Unfortunately, people who use their homes solely as personal residences cannot deduct homeowner’s insurance on their tax returns. Nonetheless, there are certain exceptions to this rule. For instance, if you have a designated home office for your work-from-home activities or if your insurance claim is denied or only partially covered, you may be eligible for a deduction for a casualty loss.

Does Washington Have the 80% Homeowners Insurance Rule?

While there is no legal requirement in Washington, most insurance companies in the state typically follow the 80/20 rule when determining claim payouts. If your home is insured for less than 80% of its replacement value, you may receive a lower reimbursement amount compared to the stated replacement value in your policy.

For instance, if the replacement cost of your home is $500,000, it is recommended to have coverage for at least $400,000 (80% of $500,000). If your coverage amount is lower than this, the insurer will only pay a percentage of the minimum coverage purchased. It is important to note that if you make significant improvements to your home, you should increase your coverage amount to 80% or more of the replacement cost.

Bundling Home and Auto Insurance in Washington

In addition to increasing your deductible, there are additional strategies to help you save money on your policy. One effective option is to bundle your home insurance with other policies, such as auto insurance, under the same company. This practice, known as bundling, often results in a premium reduction of approximately 15%.

Furthermore, you may be eligible for other discounts that can further reduce your premium. Contact your local InsureOne agent to learn more about these potential savings opportunities.

What Weather Events Affect Home Insurance Costs in Washington?

In Washington, several weather events can impact home insurance costs. These include:

- Windstorms: The state experiences strong windstorms, which can cause significant damage to homes. Insurance providers factor in the frequency and severity of windstorms when determining premium rates.

- Snow and ice storms: Cold weather events like snowstorms and ice storms can lead to roof collapses, burst pipes, and other property damage. Insurers consider the likelihood of these events and the potential costs associated with them.

- Earthquakes: Washington is located in a seismic zone, making earthquakes a significant concern. Homeowners in earthquake-prone areas may need to purchase separate earthquake insurance coverage, as it is typically not included in standard policies.

- Wildfires: During dry and hot periods, wildfires can spread rapidly, causing extensive damage to homes and properties. Homeowners in areas prone to wildfires may face higher insurance costs due to the increased risk.

- Floods: Although not directly related to weather events, flooding is another important factor to consider. This coverage option is typically separate from standard home insurance and may be required in flood-prone areas.

What are the Different Types of Home Insurance?

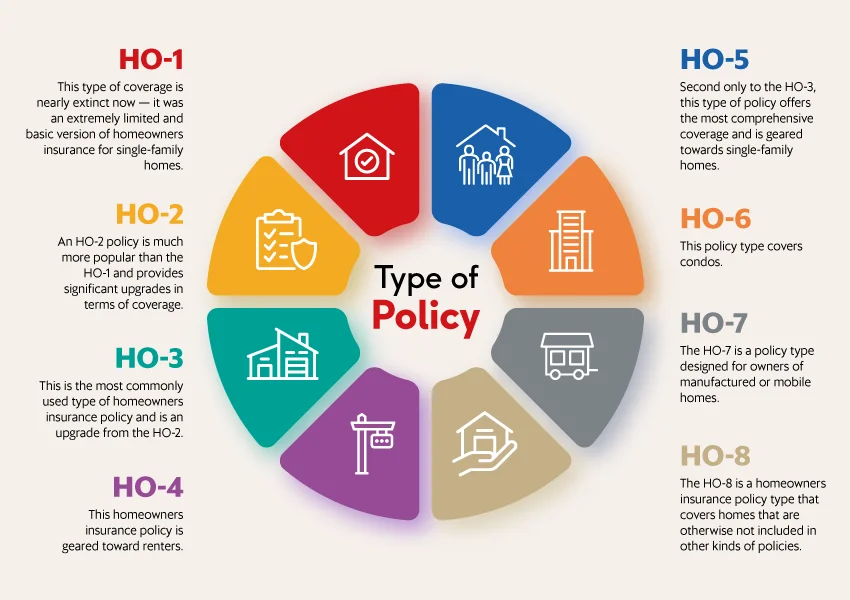

When it comes to safeguarding your home in Washington, there are 8 different types of homeowners insurance policies available. These options cater to different homes commonly found in the state, including Craftsman, Contemporary, and Tudor-style houses.

Selecting the appropriate home insurance policy is essential, and our knowledgeable team of InsureOne professionals is here to offer expert guidance every step of the way

What is the Most Common Homeowners Insurance in Washington?

The HO-3 coverage policy is a preferred option for many homeowners in Washington. This policy offers extensive protection for your house and its contents, including coverage for liability, medical payments, and additional living expenses in case you are unable to stay in your home due to a covered claim.

However, residents living in FEMA-designated high-risk flood zones in Washington may be required to acquire a separate flood insurance policy.

Get the Best Homeowners Insurance in Washington Today

Looking for the perfect homeowners insurance policy for your Washington home? InsureOne’s team of experts is here to guide you through every step of the process, ensuring that your home is comprehensively covered. Don’t wait – start protecting your peace of mind now!

To get started, give us a call at (800) 836-2240. You can also conveniently obtain a quick home insurance quote online or visit us in person at one of our convenient locations.