Arizona Homeowners Insurance Quotes

Everything You Need to Know about Home Insurance in Arizona

Arizona, located in the southwestern United States, is known for its diverse natural landscapes. The state is home to famous attractions like the Grand Canyon and the red rocks of Sedona, which offer stunning views that capture the attention of visitors. Exploring Arizona’s scenic beauty also provides an opportunity to learn about its rich Native American heritage. Historic sites like the Montezuma Castle National Monument allow travelers to experience the cultural significance of the region and connect with the traditions of the indigenous people.

Arizona’s mild winters and sunny climate make it a popular destination for outdoor enthusiasts throughout the year. The state offers a variety of activities for different interests. Hikers can explore the many trails, while those who enjoy water sports can take advantage of the lakes and rivers for boating and kayaking. Wildlife lovers will find plenty to admire in Arizona’s national parks and wildlife refuges, where they can observe a diverse range of species in their natural habitats. Whether you’re seeking natural wonders or a chance to delve into the state’s rich cultural heritage, this region has something to offer everyone.

No matter where you decide to set up your home in Arizona, there are plenty of options for you, your family, and friends on the weekends. Whether you choose a house in Phoenix or a ranch in Tucson, you’ll need homeowners insurance to protect your home and your peace of mind. At InsureOne, we can help you find the best insurance for your needs, with flexible solutions and affordable prices.

How Much Does Homeowners Insurance Cost in Arizona?

Homeowners in Arizona pay an average of $1,667 per year or $139 each month for homeowners insurance.

This aligns with the national average of $1,754. This is especially significant for Arizona residents because the state is prone to frequent and costly wildfires that can cause damage to both properties and land. As a result, having homeowners insurance is extremely important for residents to safeguard their valuable assets.

How Do Home Insurance Deductibles Affect Rates in Arizona?

The choice of home insurance deductibles in Arizona can affect the rates homeowners pay for their insurance. When homeowners increase their deductible, which is the amount they need to pay out of pocket before their insurance coverage kicks in, they have the potential to lower their insurance rates. This happens because a higher deductible means less cost for the insurance company, leading to lower premiums.

On the other hand, opting for a lower deductible could result in higher insurance rates, as the insurance company would have to cover a larger portion of the claim in case of a loss.

Compare Home Insurance Rates by Coverage Levels in Arizona

The cost of your insurance premium depends on various factors like age and location, but one of the most crucial factors is the amount of dwelling coverage included in your policy. This coverage determines how much your insurer will pay if your home needs to be rebuilt. It is vital to be realistic when determining this coverage amount because in the unfortunate event of losing your home, having sufficient funds to rebuild or purchase another one is essential.

Here are some average annual costs for residents of Arizona based on different coverage amounts.

| Dwelling Coverage (Arizona) | Average Annual Insurance Cost |

|---|---|

| $100,000 | $871 |

| $200,000 | $1,261 |

| $300,000 | $1,667 |

| $400,000 | $2,086 |

| $500,000 | $2,530 |

Is Home Insurance Tax Deductible in Arizona?

Typically, home insurance expenses cannot be deducted from your taxes. However, there may be a few exceptions that you can explore. For instance, if you have a home office and work from home, you may be able to deduct some of the expenses related to your home business.

Additionally, if you were denied a claim during the year, you also may be eligible to request a deduction for a portion of your home insurance expenses. It’s important to consult with a tax professional or accountant to understand the specific circumstances under which these deductions may apply to your situation.

Does Arizona Have the 80% Homeowners Insurance Rule?

Most insurance companies follow the 80% rule, but many homeowners find it confusing. Simply put, if your coverage is insufficient to cover at least 80% of your home’s replacement value, your insurance company will not fully compensate you in the event of a claim.

For instance, if your home has a replacement cost of $500,000, it should be insured for at least $400,000 (80% of $500,000). If the coverage is lower than that, the insurer will only pay a portion of the minimum coverage you purchased. Keep in mind that if you make significant improvements to your home, you need to increase your coverage to 80% or more of the replacement cost.

Bundling Home and Auto Insurance in Arizona

When it comes to saving on homeowners insurance, bundling multiple policies with the same company can make a big difference. Combining your home insurance with your auto insurance, or any other policy, can lead to savings of up to 25% on your overall policy.

Insurers value your loyalty and find it easier to manage when policies are bundled together. So, don’t forget to inquire with your InsureOne agent about the discounts you may be eligible for when you reach out to purchase or renew your policy.

So remember, bundling your auto insurance and homeowners insurance is one of the best.

What Factors do Insurance Companies Consider when Setting Rates in Arizona?

Factors such as the cost of rebuilding, proximity to fire hydrants and stations, and the type of roof on your home are among the various considerations that insurers take into account when determining your home insurance premium.

Here are a few more factors to consider:

- Age: Older homes that do not meet current codes for electrical and plumbing systems may be more expensive to repair or rebuild. Additionally, older homes might have materials that are harder to find or more costly nowadays.

- Building Materials: The composition of your home will impact your insurance premium. For instance, homes predominantly made of brick are considered less prone to fire damage compared to homes made mostly of wood.

- Location: Certain areas have an increased risk of natural disasters and wildfires. Parts of Arizona, for example, may be at higher risk of wildfires, while hail, ice, and runoff may be concerns in other regions.

- Your credit history and claims history can also affect your premium. It is advisable to consider covering small repairs out of pocket instead of filing a claim if possible.

What are the Different Types of Home Insurance?

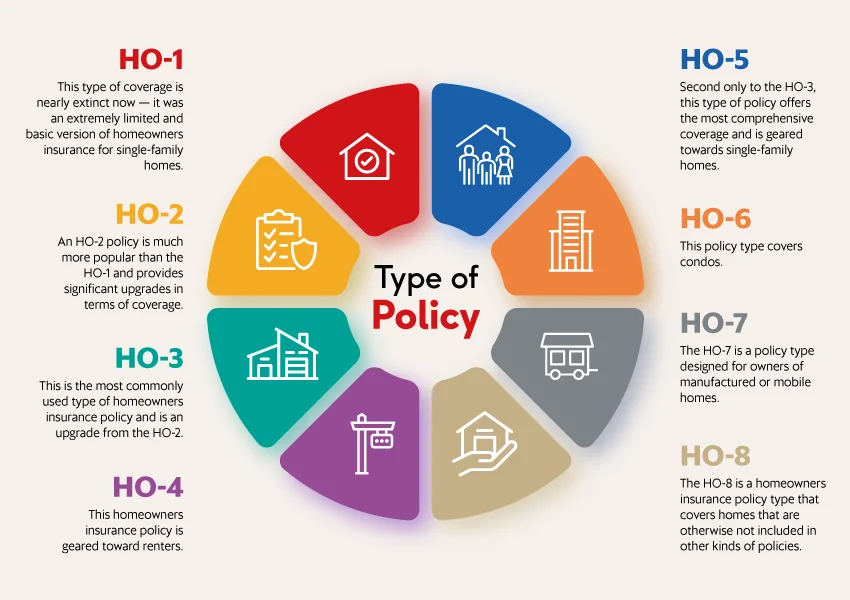

There are 8 different types of homeowners insurance policies available, all designed to provide coverage for a variety of homes found in Arizona – whether it’s a pueblo-style home in Sedona, or a modern townhouse in Scottsdale.

Choosing the right type of home insurance is crucial. Allow a knowledgeable professional from InsureOne to guide you through the process.

What is the Most Common Homeowners Insurance in Arizona?

In Arizona, the most common homeowners coverage is the HO-3 policy. However, you may discover that you require a more comprehensive policy or something entirely different to meet your specific needs.

Home insurance policies can be customized, allowing you to add riders for items such as valuable artwork or jewelry. Therefore, it is recommended that you work with an insurance expert to help you complete this process.

Get the Best Homeowners Insurance in Arizona Today

Experience convenience and peace of mind with InsureOne. Our dedicated team will take the time to understand your unique needs and budget, and provide you with personalized options that fit perfectly. Spend more quality time with your family and let us handle the rest. Get started today by calling us at (800) 836-2240, requesting a home insurance quote easily on our website, or feel free to stop by one of our locations for a face-to-face consultation with our experts.