California Homeowners Insurance Quotes

Everything You Need to Know about Home Insurance in California

Despite its reputation for lack of affordability and traffic, California is still high on the list for people who want to live in a beautiful climate, a vast array of topographical landscapes and plenty of up-and-coming fashion and food trends.

Even though California has the largest population among the states, there are still plenty of places to go and get away from it all. For those who prefer a cold winter with snow, head north to the Cascade Mountain Range where annual accumulations of snow can be up to 1,000 inches. The desert isn’t too far away for those who prefer it hot and dry (very dry)! California’s Death Valley and Mohave Desert are both located in state and national park systems, so hikers and campers can enjoy canyons, peaks, stone sculptures and sand dunes.

If you prefer your sand dunes to be in front of an ocean, head west (and then south to north) for California’s 840-mile-long coastline. Many of these beaches are tourist meccas, but locals know the spots to go for a secluded swim and a private beach party. Many residents of the Golden State have chosen to live in one of the breathtaking Santa

Monica Mountains’ canyons that are part of the sprawling Los Angeles landscape: here you can find both privacy and crowded residential neighborhoods.

If the fun and sun of the beach life appeals to you, southern California is a mild climate with plenty of sun and surf. Wherever you choose to put down roots, you’ll need to find California home insurance that is suited for your specific needs. At InsureOne, we are the experts at finding the best insurance for your situation – with flexible solutions and affordable prices.

How Much Does Homeowners Insurance Cost in California?

The average cost of a home insurance policy for a $300,000 home is roughly $1,400 annually. This is actually less than the national average of approximately $1,800. It may be surprising to some to find out that the Golden State is actually lower than the average in any type of pricing but especially those concerned with housing costs. But Californians don’t face many of the same threats other coastal states do. It’s rare to have a hurricane hit near California.

In recent years, however, wildfires and drought have not only started causing rates to rise, but also more insurers refusing to cover certain housing in targeted areas. California legislation designed to protect homeowners from constant rate increases have resulted in some companies refusing to offer coverage in certain areas or leaving the state altogether.

Construction costs in California have further aggravated the situation since they’ve continued to rise over the last few years due to ongoing supply chain issues and labor shortages.

How to Find Home Insurance in California

Some Californians may have trouble finding a company to insure their home. There are some things you can do that may help if you find yourself in this situation.

Communicate with Your Carrier

If your insurer doesn’t renew your policy or outright cancels it, give them a call and find out if there’s anything you can do to make your property safer. You may make some headway if you take steps to fireproof your home. You can install a fireproof roof and clear an open space around your home. You can find some helpful information from the Wildfire Prepared Home initiative.

Consider the California FAIR Plan

If you cannot find home insurance, you can try for the California FAIR plan. This is a more expensive option that is limited in coverage, but may get you through for the time being, until you can make other arrangements.

At InsureOne, we specialize in taking the time to help our customers find the best coverage. Let us do the shopping for you, so you can have more choices and less stress.

How Do Home Insurance Deductibles Affect Rates in California?

One of the things you’ll need to decide on for your home insurance (and your car insurance) is what your deductible should be. In both cases, the higher the deductible, the lower the premium. That’s because you are saying that, in a covered event, you will assume more of the financial cost. Insurance companies typically reward those who are willing to take a larger portion of the payout.

If your deductible is $2,000 and your claim is worth $7,000, you will pay $2,000 and your insurer will pay $5,000. This is one way to lower your premium.

Compare Home Insurance Rates by Coverage Levels in California

One of the most important factors determining your premium amount is how much dwelling coverage your policy is worth. This number represents how much it will cost to rebuild your home in the event of a total loss. It’s best to be completely honest about this number; you don’t want to need it and not have it. Here are some average annual costs for New Yorkers based on the value of their home.

| Dwelling Coverage (California) | Average Annual Insurance Cost |

|---|---|

| $100,000 | $596 |

| $200,000 | $990 |

| $300,000 | $1,383 |

| $400,000 | $1,775 |

| $500,000 | $2,175 |

At InsureOne, we can help you find the best home protection at the best price. We’ll shop around for you and provide you with the top options so you can choose.

Is Home Insurance Tax Deductible in California?

Not generally, no. There are some exceptions to this, but for the most part, you won’t be able to deduct your home insurance from your taxes. If you have a home office that you work from, you may be able to take advantage of a deduction.

Does California Have the 80% Homeowners Insurance Rule?

Almost all insurance companies use the 80% rule, but many homeowners are confused by the whole concept. Simply put, if you don’t have enough coverage to pay for at least 80% of your home’s replacement value cost, your insurance company will not payout the full amount of your policy in the event of a claim.

For example, a home with a replacement cost of $500,000 should be covered for at least $400,000 (80% of $500,000). If the home is insured for less than that, the insurer will only pay out a portion of the minimum coverage purchased. Remember, if you make capital improvements to your home, you’ll need to increase your coverage amount to 80% or higher of the replacement cost.

Bundling Home and Auto Insurance in California

Besides increasing your deductible, there are other ways to save money on your policy. For example, you can bundle your home insurance and auto insurance (or any other policy) together with the same company. Allowing one company to handle more than one policy can net you up to 25% off.

Be sure and ask your InsureOne agent what discounts you may qualify for when you contact them to purchase or renew your policy.

What Factors do Insurance Companies Consider when Setting Rates in California?

Insurance carriers take many factors into consideration when setting your premium cost. With home insurance, the list is long, but here are a few items you can be sure the underwriters will consider.

- Age of Home: Some older homes may be more expensive to insure due to code considerations with electrical and plumbing, as well as hard-to-find materials.

- Building Materials: Brick homes are generally considered less of a fire hazard than wood homes, so would probably cost less to insure.

- Location: If your home is located in an area prone to natural disasters, this can raise your rates. Carriers also look at the distance from your home to the nearest fire hydrant, as well as the fire department.

Your credit history may also have a bearing on your rates, as well as your claims history. If you can afford to pay for damage out of pocket, in the long run this may be the cheaper option than filing a claim.

What are the Different Types of Home Insurance?

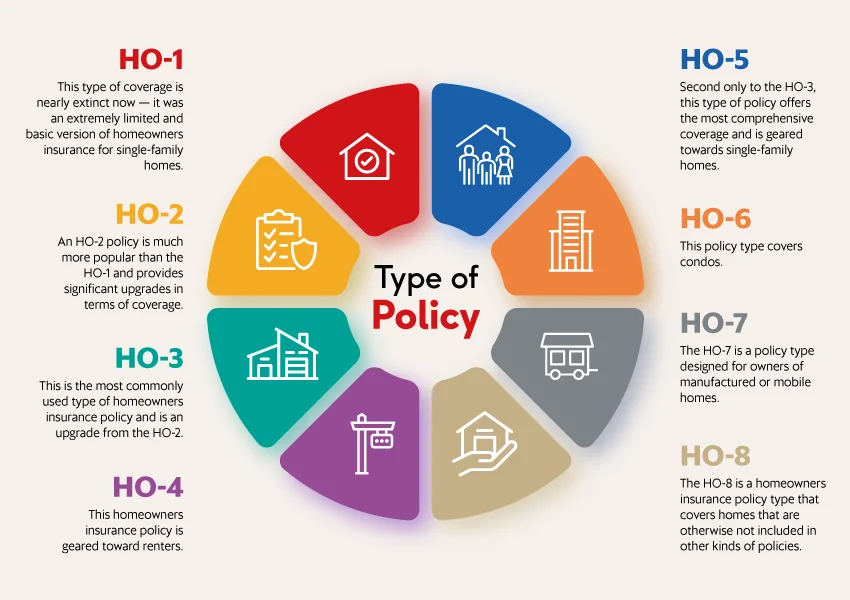

There are 8 different types of homeowners insurance policies and they all provide coverage for that special place you call home – whether it’s a split-level ranch in San Diego or a condo in San Francisco.

Most people buy an HO-3 policy, the most common homeowners coverage in California. However, you may find that you need a more comprehensive policy or something different altogether. Home policies are customizable, so you can add riders for different things, such as expensive art or jewelry.

Purchasing the correct type of home insurance is vital. Let an InsureOne professional guide you through the process.

What is the Most Common Homeowners Insurance in California?

It depends on where you live in the Golden State. California changes drastically from oceanfront beaches to the deserts of Palm Springs. You may live in congested Los Angeles or high-tech San Fran. If you are even further north, you might be surrounded by forests.

Home insurance is not a one-size-fits-all proposition. Each homeowner has specific needs, so find an agent that is flexible and happy to get the best policy for your unique situation.

Get the Best Homeowners Insurance in California Today

At InsureOne, we’ll listen to your needs and budget and research options for you so you can spend time doing things you love, like spending time with your family. At our one-stop shop, we’ll present you with competitive options tailored specifically to you. Reach out to us today by phone at (800) 836-2240 or find a quick home insurance quote online. You are also welcome to stop by one of our convenient California locations.

Homeowners Insurance Info by City

Anaheim

Bakersfield

Clearlake

El Centro

Eureka

Fairfield

Fremont

Fresno

Hayward

Lancaster

Long Beach

Los Angeles

Madera

Merced

Napa

Oakland

Ontario

Oxnard

Pleasanton

Redding

Riverside

Sacramento

Salinas

San Bernardino

San Diego

San Francisco

San Jose

San Leandro

San Luis Obispo

Santa Ana

Santa Cruz

Santa Maria

Santa Rosa

Sonora

Stockton

Susanville

Truckee

Ukiah

Vallejo

Van Nuys

Visalia