Virginia Homeowners Insurance Quotes

Everything You Need to Know about Home Insurance in Virginia

They say “Virginia is for lovers,” and that’s especially true for people who live here. The state is steeped in history, having been the location of the first British colony, Jamestown. Because of this perceived English rule, the state has earned the nickname “The (Old) Dominion State”. More presidents have been born here than in any other state, earning it another nickname: Mother of Presidents.

Native Americans lived on these fertile lands since as far back as 1,200 BC. Through the ages, famous Civil War battles were fought here, including the Battle of Bull Run. Colonial Williamsburg is the world’s largest living history museum and Mount Vernon, the home owned by George and Martha Washington.

There are 8.6 million people who call Virginia home and if you are one of them, or plan to be, you’ll need to find the best homeowners insurance at the best price. Let an InsureOne agent do the research for you, so you have more time to enjoy the many attractions this state has to offer.

How Much Does Homeowners Insurance Cost in Virginia?

Virginia has a mild climate, especially compared to its neighbors to the north and south. Located in the middle of these extremes, residents typically enjoy the warm and humid summers of its southern neighbors and much lighter winters than its northern bordered states. This may be one reason Virginia homeowners pay less for coverage than the national average.

For $300,000 in dwelling coverage, Virginians pay an average of $1,277 annually. The national average is $1,754 per year.

Although Old Dominion does have regular visitors throughout the year in the form of thunderstorms, tornadoes and winter storms, those who live inland will pay less than those who live near the coast.

Your premium will vary from your neighbor’s cost since many factors are taken into account when arriving at a policy price.

How Do Home Insurance Deductibles Affect Rates in the Dominion State?

Just as in almost all types of insurance, your insurance company will expect you to be a financial partner in your contract by assuming some type of deductible. A deductible is how much you agree to pay in the event of an approved claim. The more you are willing to assume, the less your insurer will charge you overall for your premium.

For example, if you set your deductible at $2,000, that’s $2,000 your carrier doesn’t have to pay if your roof blows off in a storm. The average cost of replacing a roof in Virginia is between $7,000 and $12,000, so you’ll be saving your insurance company quite a bit by assuming a higher deductible.

If you want to learn more about how your deductible works, check out this article on home insurance deductibles.

Comparing Home Insurance Rates by Coverage Levels in Virginia

Your dwelling coverage limit is generally close to the replacement cost value (RCV) of your home. RCV is how much it will cost to build a new home or bring a home back to its original condition. Many factors go into determining this number, including the age of the home, what materials the home is made of and more. Here are some average annual costs for Virginians based on the dwelling coverage.

| Dwelling Coverage (Virginia) | Average Annual Insurance Cost |

|---|---|

| $100,000 | $630 |

| $200,000 | $933 |

| $300,000 | $1,277 |

| $400,000 | $1,625 |

| $500,000 | $2,000 |

At InsureOne, we can help you find the best home protection at the best price. We’ll shop around for you and provide you with the top options so you can choose.

Is Home Insurance Tax Deductible in Virginia?

In most cases, you will not be able to take a deduction for your home insurance cost in Virginia. There are a few exceptions, such as having a business in your home or even a home office. If you think you have a legitimate deduction, contact your tax professional for guidance.

Does Virginia Have the 80% Homeowners Insurance Rule?

Most insurance agencies use the 80% rule. The 80% rule states the insurer is not required to pay out the maximum policy amount for an approved claim if the policy itself is worth less than 80% of your home’s RCV. Because this language is most likely in your policy, it’s vital that you stay abreast of your home’s replacement value. Inflation, renovations and more can increase your home’s RCV, so remember to keep in touch with your agent to update that amount when necessary.

An example of the 80% rule is having a policy worth at least $220,000 (80%) for a home with a RCV of $275,000.

Is Bundling Home and Auto Insurance in Virginia a Good Idea?

Yes. Virginia homeowners can find serious savings when they bundle different policies together with one company. For example, bundling auto insurance with home insurance can be worth up to 25% off your premium.

What Weather Events Affect Home Insurance Costs in Virginia?

Depending on where they live in the state, Virginians face different weather events. Those who have a chateau in Charlottesville won’t face the same weather as someone who owns a hacienda in Hampton. People located near the beaches and the Atlantic Ocean face threats from hurricanes, while those who live in Fredericksburg are very close to Washington, D.C. and receive roughly 16 inches of snow each year.

Understanding what weather risks you face where you live is important when choosing a home policy.

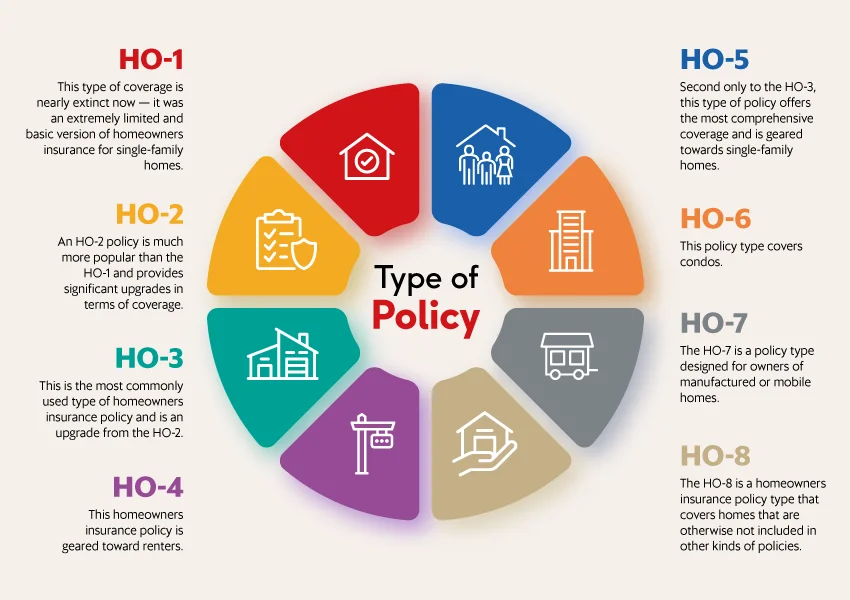

What are the Different Types of Home Insurance?

There are different types of homeowners insurance policies and they all provide coverage for that special place you call home.

Purchasing the correct type of home insurance is vital. Let an InsureOne professional guide you through the process.

What is the Most Common Homeowners Insurance in Virginia?

There are many older homes in Virginia since it is a place with a lot of history. Some of these older homes are harder to repair or replace due to outdated plumbing and electrical systems, and hard-to-find features. If this describes your home, you may want to consider and HO-8 policy. Most people with a single family home purchase an HO-3 policy.

Where you live in Virginia may affect the things you’ll want to insure against. For example, those who live at the coast will insure for different perils than those who live in the hill country. Although the Virginia hill country does see flooding and other damages from thunderstorms, it isn’t as likely to see a hurricane or tornado as other parts of the Dominion State.

If you live in an area prone to flooding, you may want to explore flood coverage, which you can get through the federal government.

Get the Best Homeowners Insurance in Virginia Today

At InsureOne, we offer a concierge-type of home insurance buying experience. We know your time is precious. That’s why our experienced agents will shop around and compare various A-rated insurance companies that best fit your needs – and your budget. Our options are customizable and flexible.

Reach out to us today by phone at (800) 836-2240 or find a quick home insurance quote online. You are also welcome to stop by one of our convenient New York locations.