Minnesota Homeowners Insurance Quotes

Everything You Need to Know about Home Insurance in Minnesota

Minnesota is a hidden gem for tourists and residents seeking natural beauty and outdoor adventures. With over 10,000 lakes and sprawling forests, the state provides an idyllic setting for activities like kayaking, fishing, and hiking. Nature enthusiasts can explore the landscapes of places like Boundary Waters Canoe Area Wilderness or enjoy a boat ride on Lake Minnetonka.

Beyond its natural wonders, this state offers a rich cultural experience. It is home to numerous museums, art galleries, and theaters that showcase its arts scene. Visitors can explore the famous Minneapolis Sculpture Garden, attend live performances at the Guthrie Theater, or immerse themselves in local history at the Minnesota History Center. Additionally, Minnesota hosts festivals and events throughout the year, celebrating diverse cultures and cuisines.

If you live in Minnesota, it’s crucial to have dependable home insurance to safeguard your property. InsureOne provides the best homeowners insurance coverage at the most competitive prices, ensuring your home and possessions are protected.

How Much Does Homeowners Insurance Cost in Minnesota?

The average cost of homeowners insurance in Minnesota is approximately $1,859 per year, or around $152 per month, for a policy with $300,000 in dwelling coverage. This is 4% higher than the national average of $1,754 per year.

This cost is influenced by a combination of factors like sustained inflation, labor shortages, rising construction costs, and severe natural disasters. Keep reading to learn more about it.

Does Minnesota Have the 80% Homeowners Insurance Rule?

To ensure full coverage, it is typically required by most insurance providers that homeowners purchase dwelling coverage worth at least 80% of their home’s replacement cost. For instance, let’s say your home’s replacement cost is $350,000. In this case, you would need dwelling coverage of at least $280,000 for the insurer to fully cover potential claims.

However, many homeowners make the mistake of not adjusting their coverage over time, even though factors like inflation and home improvements can impact the overall replacement cost. As a result, they may be caught off guard if a disaster or loss occurs and the insurance company does not provide full coverage for replacing their home.

To avoid such surprises, it is crucial to remember the importance of maintaining at least 80% of the replacement cost of your home in insurance. In case you fail to meet this requirement, the insurance company may only pay the difference between 80% of the replacement cost and the coverage amount you purchased. To stay well-informed and make good decisions, consider reading “”.

How Do Home Insurance Deductibles Affect Rates in MN?

Understanding how deductibles can impact your home insurance rates is crucial when securing coverage. A deductible refers to the amount you must pay out of pocket before your insurance takes effect and covers the remaining portion of your claim.

In general, opting for a higher deductible can result in lower premiums because you are assuming more financial responsibility in the event of a claim. However, striking the right balance is essential. It is important to select a deductible that not only helps you save money on premiums but is also feasible for you to pay if you need to file a claim.

Suppose you have a deductible of $2,500, and your home is damaged in a severe winter storm leading to $6,000 in damages. In this scenario, you will be responsible for paying the initial $2,500, while your insurance will cover the remaining $3,500. We highly recommend reading “Everything a New Homeowner Needs to Know About Home Insurance” to gain a comprehensive understanding of how deductibles work and other important aspects of home insurance.

At InsureOne, our experienced agents can assist you in finding the optimal deductible that meets your coverage needs and fits within your budget requirements.

Compare Home Insurance Rates by Coverage Levels in the Land of 10,000 Lakes

The following table showcases the average annual premium in Minnesota for five different levels of dwelling coverage, which refers to the part of your policy which protects you financially against the cost of structural damage to your home.

| Dwelling Coverage (Minnesota) | Average Annual Insurance Cost |

|---|---|

| $100,000 | $953 |

| $200,000 | $1,367 |

| $300,000 | $1,829 |

| $400,000 | $2,328 |

| $500,000 | $2,872 |

Find top-rated home insurance from national carriers at affordable prices. Let InsureOne agents provide excellent customer service and flexible plans tailored to your needs.

Is Home Insurance Tax Deductible in Minnesota?

Although home insurance costs in Minnesota are generally not tax deductible, there are some situations in which you may be able to deduct associated expenses from your income tax. For instance, if you use your home as an office or rental space, you may qualify for deductions related to those specific uses.

It is important to understand that tax laws are complex and often subject to changes. To ensure accurate and personalized guidance, it is advisable to consult with tax professionals who can provide expert advice based on your specific circumstances.

Bundling Home and Auto Insurance in MN

Bundling home and auto insurance from the same provider offers cost-effective advantages such as convenience, potential savings, and simplified policy management.

In Minnesota, bundling can lead to an annual discount of an 18% reduction in premium. Bundling also provides more comprehensive protection and additional benefits. To enjoy these perks, compare quotes, consult with insurance agents, and consider the 9 Tips to Save on Homeowners Insurance.

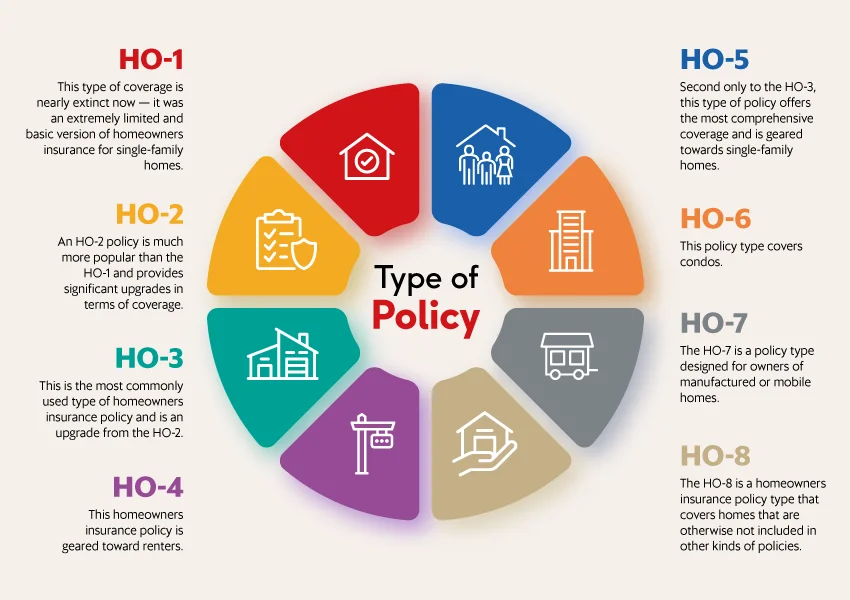

What are the Different Types of Home Insurance?

In Minnesota, single-family homes are the most prevalent type of housing with 70% of all units being single family. Apartments and townhouses make up the second and third largest categories. Each of these housing classes has unique insurance requirements, and there are various types of home insurance coverages available to cater to the specific needs.

If you are unsure about which class of home insurance policy is best for you, we highly recommend seeking guidance from a specialized agent. Their expertise enables them to assess your unique situation and tailored protection for your home.

What Weather Events Affect Home Insurance Costs in Minnesota?

In Minnesota, weather events such as winter storms, hail and floods can impact home insurance costs. It’s important to consider these risks when searching for insurance coverage.

Winter storms can cause damage like fallen trees, collapsed roofs, and frozen pipes. Most homeowners’ insurance policies cover these damages, but it’s important to review your coverage and take steps to protect your home, such as leaving the heat on when you’re away.

Hail is common in Minnesota and can cause significant property damage. Make sure to carefully review your policy as coverage may only apply if there’s substantial damage to your home’s siding or roof. Additionally, there may be a separate deductible for hail or wind damage.

Due to numerous lakes and heavy rain and snowmelt, flooding is also a risk in Minnesota. However, standard homeowners’ insurance policies generally don’t cover flood damage. Consider purchasing additional flood insurance coverage to stay protected.

What is the Most Common Homeowners Insurance in Minnesota?

The HO-3 policy, also known as the Special Form policy, is a popular and extensive choice for Minnesota homeowners. It offers comprehensive coverage for a wide range of risks that could damage your home and personal belongings.

Key features of the HO-3 policy include coverage for your home at replacement value and ensuring financial protection in the event of a total loss. It also provides coverage for personal belongings, offering peace of mind for the protection of your valuable possessions. To enhance your coverage and ensure true peace of mind, it is recommended to consider adding flood insurance to your policy. This additional coverage will provide added security and protection against potential water damage in the Land of 10,000 Lakes.

Get the Best Homeowners Insurance in Minnesota Today

At InsureOne, we understand the importance of your needs and budget. Leave the research to us as we find the best options tailored for you, allowing you to prioritize quality time spent with your family. You can easily get in touch with us by phone at (800) 836-2240, or easily obtain an instant home insurance quote online. You can also visit one of our convenient locations. Rest assured, we are here to provide you with the insurance solutions you require.