Mississippi Homeowners Insurance Quotes

Everything You Need to Know about Home Insurance in Mississippi

Mississippi is a state that offers natural beauty, cultural heritage, and warm hospitality. From its beaches along the Gulf Coast, visitors can bask in the sun, go fishing, or indulge in water sports. Inland, the state boasts national parks, perfect for hiking, camping, and wildlife spotting.

This region is a treasure trove for history enthusiasts. The battlefields and landmarks of Vicksburg National Military Park—where people can immerse themselves in the country’s past—are just one example. Additionally, Mississippi is known as the birthplace of blues music, and cities like Clarksdale and Jackson offer live performances and museums celebrating this iconic genre.

If you plan to move to Mississippi or already live there, it’s important to protect your home and belongings with a reliable insurance policy. At InsureOne, we provide the best homeowners insurance at the lowest possible rates, ensuring that your residence is safeguarded.

How Much Does Homeowners Insurance Cost in Mississippi?

The cost of homeowners insurance in Mississippi is significantly higher than the national average. On average, residents pay around $2,624 each year—approximately 50% more than the national average of $1,754 per year.

Insurance rates in this state are influenced by climatic conditions unique to the state, such as hurricanes, tornadoes, and heavy rainfall.

Does Mississippi Have the 80% Homeowners Insurance Rule?

The 80% rule is a crucial provision typically found in home insurance policies. It states that if you have less than 80% of your home’s replacement cost value (RCV) as dwelling coverage, your insurance company may not fully pay out your claim.

To avoid this situation, Mississippi homeowners should ensure they have at least 80% of their home’s RCV in insurance coverage. The RCV represents the amount needed to rebuild your home completely in the event of a total loss, while the dwelling coverage is the specific amount stated in your policy.

For example, if your home’s RCV is $300,000, your dwelling coverage should be at least $240,000, which is 80% of the RCV. To determine your home’s RCV, you can search online for the prevailing rates of materials and labor in your area. This will provide a rough estimate based on the cost per square foot to build a home in your locality.

Alternatively, when you purchase home insurance, your insurer will calculate the RCV by considering various details specific to your home. These calculations are typically accurate. Keep in mind that any property improvements or inflation may increase your RCV. Stay informed by reading “7 Most Common Mistakes That Keep Your Home Insurance From Paying Out“.

How to Find Home Insurance in MS

Navigating the home insurance market in Mississippi can be daunting. However, there are proactive measures you can take to increase your chances of securing the best coverage.

1. Shop around and compare quotes: Obtain quotes from multiple insurance providers to ensure you are getting the most comprehensive coverage at competitive rates. Insurance prices can vary, so it’s important to explore different options.

2. Understand your coverage needs: Consider the value of your home and belongings, as well as any additional coverage you may need.

3. Explore discounts: Look into the discounts that insurance companies may offer. For instance, some insurers offer discounted rates for home security systems or combining policies with other insurance products.

4. Get guidance from an independent insurance agent: Consider seeking advice from an independent insurance agent who can offer personalized assistance and expert recommendations in choosing the insurance coverage that best suits your specific needs.

5. Review every detail of your policy: It’s essential to carefully read through the policy details, ask questions, and fully understand what is covered before finalizing any home insurance purchase in Mississippi.

How Do Home Insurance Deductibles Affect Rates in Mississippi?

Deciding on the appropriate deductible amount is a crucial step when selecting your home (or auto) insurance policy. Opting for a higher deductible can result in a lower premium for either policy. By choosing a higher deductible, you’re indicating that you’re willing to cover a larger portion of the financial burden in the event of a covered claim. Insurers often provide incentives to policyholders who are willing to assume a greater payout.

For example, suppose your deductible is $2,500, and you have a covered claim worth $8,000. In this scenario, you’ll need to pay the initial $2,500, while your insurance company covers the remaining $5,500. This approach offers a practical way to reduce your premium expenses. To gain a better understanding of how deductibles and other essential factors function, we highly recommend reading our informative article titled “6 Things That Can Increase Your Homeowners Insurance“.

Compare Home Insurance Rates by Coverage Levels in the Magnolia State

The dwelling coverage included in your policy plays a critical role in determining the cost of your premium. This coverage amount safeguards you from bearing the financial burden of repairing structural damages on your own.

To provide you with a glimpse of the average annual expenses in Mississippi based on different coverage amounts, refer to the table below.

| Dwelling Coverage (Mississippi) | Average Annual Insurance Cost |

|---|---|

| $100,000 | $1,207 |

| $200,000 | $1,918 |

| $300,000 | $2,624 |

| $400,000 | $3,363 |

| $500,000 | $4,227 |

At InsureOne, we can help you find the best home protection at the best price. We’ll shop around for you and provide you with the top options so you can choose.

Is Home Insurance Tax Deductible in MS?

Typically, home insurance premiums cannot be deducted from your taxes. However, there are a few exceptions to this rule. If you have a dedicated home office and work from home, you may be eligible to claim a tax deduction for your home insurance expenses.

Bundling Home and Auto Insurance in Mississippi

Beyond increasing your deductible, there are other strategies to save money on your policy . You may consider bundling other policies such as your home and auto insurance with a single insurance company. Combining these policies with one insurer can result in as much as $534 or 15% worth of savings annually.

To explore these options, it’s a good idea to reach out to your InsureOne agent, who can assist with the purchase or renewal of your policy. They can also provide information on any discounts you may qualify for, which can help identify the most cost-effective policy for your needs.

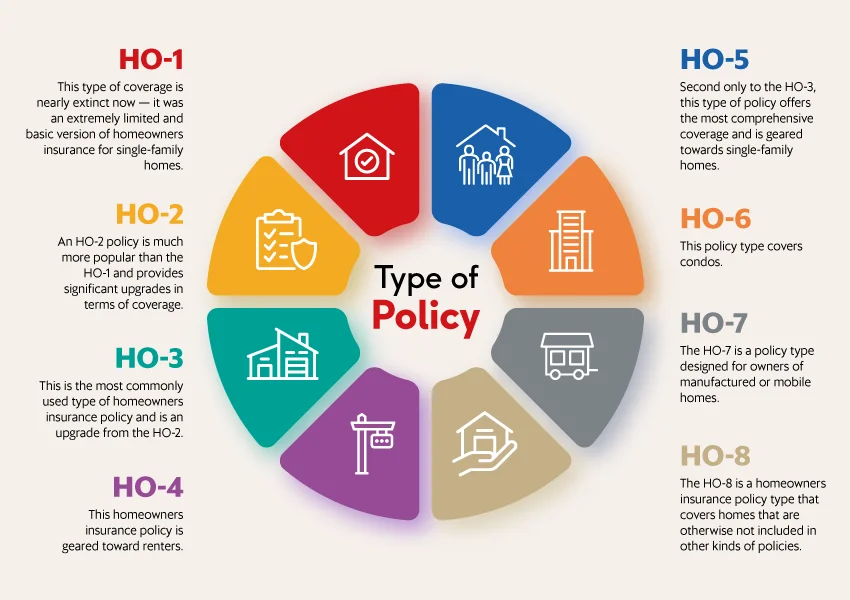

What are the Different Types of Home Insurance?

According to the (MHS), federal-style architecture homes were among some of the first built in Mississippi. These feature classical columns and ornamentation inspired by ancient Roman architecture. For proper protection, we recommend opting for an HO-5 or HO-8 policy.

The HO-5 policy is known as a comprehensive or open perils policy, providing coverage for both the dwelling and personal belongings against a wide range of risks or perils, unless explicitly excluded in the policy. This type of policy typically offers broader coverage than other standard policies, such as the HO-3 policy.

On the other hand, the HO-8 policy is often referred to as a modified or historical home policy. It is designed specifically for older homes that may have unique features or construction that make it difficult to insure under standard replacement cost policies. In any case, if you want to make an adequate choice among the 8 different types of home insurance policies, it is best to receive advice from a specialized agent. At InsureOne, we are ready to accompany you step by step.

What Factors do Insurance Companies Consider when Setting Rates in MS?

Insurance companies consider several factors to determine the cost of coverage. These factors help insurers assess the level of risk associated with insuring a particular home and its contents. Key considerations include:

1. Location: The geographic location of the home plays a significant role in determining the insurance rates. Factors such as proximity to coastlines, floodplains, and areas prone to natural disasters like hurricanes or tornadoes can impact the risk level and, consequently, the cost of coverage.

2. Construction and age of the home: The type of construction materials used in the home and its age can affect insurance rates. Homes made of fire-resistant materials like brick and stone may attract lower premiums compared to those made of wood. Similarly, older homes often have higher insurance rates due to factors like outdated electrical systems or plumbing.

3. Home security measures: The presence of security measures can reduce the risk of theft and damage to the home. Insurance companies may offer discounts for homes with features like security systems, smoke alarms, deadbolt locks, and fire extinguishers.

What is the Most Common Homeowners Insurance in Mississippi?

Although many people have an older home in this state, the majority of homeowners have at least an HO-3 policy. The HO-3 policy is a popular choice among homeowners as it provides coverage for the dwelling and personal property against a specific list of perils or risks, such as fire, theft, vandalism, and certain natural disasters. It offers a comprehensive level of protection for most typical situations homeowners may face.

If you’re considering this type of policy, it’s essential not to overlook the importance of purchasing flood insurance as well. Living in Mississippi, which is located near the Gulf of Mexico, poses a common risk of flooding. If you’re still unsure about the necessity of this option, we invite you to read our article “Why is Flood Insurance Important for Every Homeowner?“.

Get the Best Homeowners Insurance in Mississippi Today

At InsureOne, we make your needs and budget our top priority. We conduct thorough research to find the best insurance options for you, allowing you to focus on what’s most important – spending quality time with your family. Our knowledgeable team is available to speak with you at (800) 836-2240 or you can easily obtain an instanthome insurance quote online. Alternatively, you can visit us at one of our convenient locations to discuss the insurance solutions that you require.