Connecticut Homeowners Insurance Quotes

Everything You Need to Know about Home Insurance in Connecticut

Connecticut, located in the northeastern part of the United States, offers visitors a delightful blend of history and natural beauty. Explore charming coastal towns like Mystic, known for its historic seaport and maritime heritage. Immerse yourself in the world of art and culture at renowned Yale University and its prestigious art galleries and museums in New Haven. Additionally, you can visit the picturesque landscapes of Litchfield Hills, where you can hike, bike, or simply relax amidst rolling hills and tranquil lakes.

Connecticut’s capital city, Hartford, embraces the captivating blend of history and natural splendor that defines the state. Delve into the rich heritage of this vibrant city with a visit to the Connecticut State Capitol, a magnificent architectural gem steeped in history. Stroll along the riverfront and admire the skyline views or explore the diverse array of museums and cultural institutions such as the Mark Twain House and Museum, where you can delve into the world of the famous author. Hartford seamlessly combines the charm of its historic past with stunning parks and gardens, offering visitors a truly enchanting experience in the heart of Connecticut.

For many reasons, Connecticut is the perfect place to live. If you are a resident or thinking about moving here soon and buying a home, remember that you will need homeowners insurance. InsureOne offers the highest level of protection so you can know you are getting the best protection at an affordable rate.

How Much Does Homeowners Insurance Cost in Connecticut?

The average annual cost of homeowners insurance in Connecticut is $1,405, which is 23% lower than the national average of $1,820. However, it is important to consider more than just the price when selecting insurance for your

home. It is crucial to ensure that your policy provides adequate coverage for the specific challenges you may encounter in Connecticut, such as storms and winter weather.

How Do Home Insurance Deductibles Affect Rates in Connecticut?

When it comes to home insurance in Connecticut, deductibles play a significant role in determining rates. The deductible is the amount that homeowners are responsible for paying out of pocket before their insurance kicks in. Generally speaking, higher deductibles result in lower insurance premiums, while lower deductibles lead to higher premiums.

For example, if a homeowner in Connecticut selects a higher deductible of $2,500, their out-of-pocket expense would increase, but they would likely enjoy lower insurance premiums. On the other hand, if the deductible is low at $500, their out-of-pocket expense would be less, but their insurance premiums would be higher. Here is an informative article to help you understand further how deductibles work: home insurance deductibles.

Comparing Home Insurance Rates by Coverage Levels in Connecticut

Your replacement cost value (RCV) is the estimated cost of re-building your old home or building a new one, and it is determined based on a variety of factors, including the age and materials of the home. It should be noted that RCV is not the same as the market value of your home. Therefore, it’s crucial to review your homeowners insurance policy periodically with your insurance company or agent to ensure that you have adequate coverage in Connecticut. It’s also essential to inform your insurance provider of any significant home renovations or improvements that can affect your RCV.

Moreover, it may be beneficial to consider purchasing extended replacement cost coverage or guaranteed replacement cost coverage, which can provide additional protection beyond the basic RCV to cover potential cost overruns in the event of a catastrophic loss.

Here are some average annual costs for homeowners in Connecticut, based on the coverage amount:

| Dwelling Coverage (Connecticut) | Average Annual Insurance Cost |

|---|---|

| $100,000 | $645 |

| $200,000 | $987 |

| $300,000 | $1,329 |

| $400,000 | $1,689 |

| $500,000 | $2,090 |

At InsureOne, we can help you find the best home protection at the most affordable price. Let us do the work for you!

Is Home Insurance Tax Deductible in Connecticut?

In the United States, including Connecticut, you generally can’t deduct home insurance premiums from your federal income tax return. Homeowners insurance is considered a personal expense, not a deductible business expense. However, there are some exceptions and special cases to keep in mind. For example, if you run a business from your home, have rental properties, or qualify for home office deductions, you may be able to take advantage of certain tax benefits.

Does Connecticut Have the 80% Homeowners Insurance Rule?

In Connecticut, there is no specific state law or regulation that enforces a minimum requirement for homeowners to have insurance coverage. However, it is common for many insurance companies and agents in Connecticut, as well as across the country, to follow this guideline as a standard procedure when assisting homeowners in assessing their coverage needs. Therefore, you may come across this standard practice when shopping for home insurance.

Remember, It’s important to understand the provisions related to coverage limits and requirements that come with your insurance policy to make informed decisions about your coverage. Make sure to read through your policy carefully and ask your insurance agent any questions you may have.

Is Bundling Home and Auto Insurance in Connecticut a Good Idea?

- Combining home and auto insurance in Connecticut, as well as in numerous other states, is often a wise choice for several reasons. The benefits include cost savings, convenience, simplified coverage, multi-policy discounts, potential loyalty rewards, and a smoother claims process.

What Weather Events Affect Home Insurance Costs in Connecticut?

Certain weather events can affect how much you pay for home insurance in Connecticut. This includes floods, hurricanes, thunderstorms, and snowstorms. When these natural disasters hit, they can cause serious damage to homes, which in turn leads to higher insurance costs.

On top of that, climate change has been causing more frequent and severe weather events, making insurance rates go up even more. Insurance companies take all of these factors into account when deciding how risky it is to insure a property and setting the price for the insurance policy.

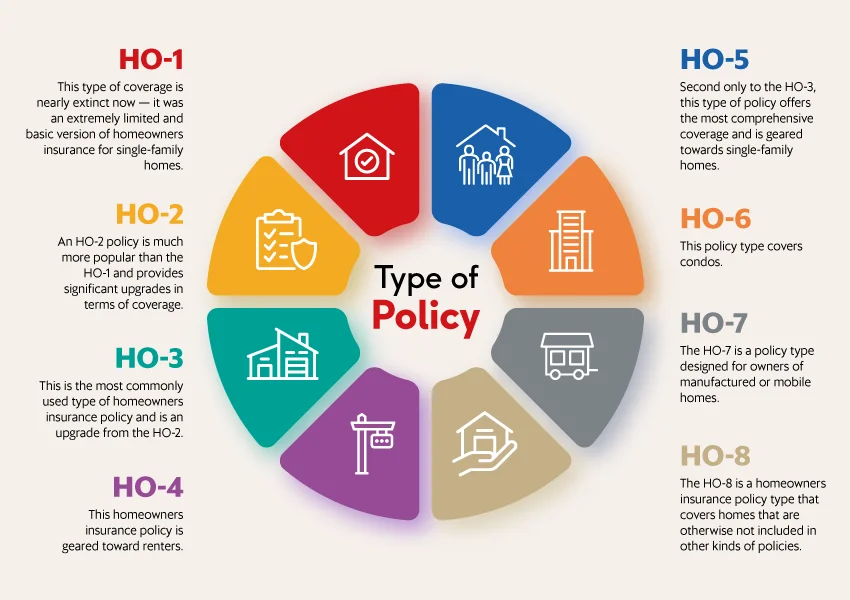

What are the Different Types of Home Insurance?

There are various types of homeowners insurance policies that offer coverage for your unique home, whether it’s a ranch house in Hartford or a waterfront property in Westport.

InsureOne professionals understand the unique features and requirements of homes in Connecticut and are dedicated to guiding you through the insurance process, ensuring you have the right coverage for your cherished home.

What is the Most Common Homeowners Insurance in Connecticut?

In Connecticut, the most prevalent homeowners insurance policy, much like in other states, is the HO-3 policy. This widely-used policy provides comprehensive coverage for a range of risks.

However, it’s essential to consider the specific region you reside in, as different areas of Connecticut may have unique coverage requirements. For instance, coastal regions like Fairfield and New Haven County are prone to tropical storms and hurricanes, making it vital to have adequate coverage for wind and water damage. Inland regions, such as Litchfield and Hartford County, may face risks of severe winter weather, including heavy snowfall and ice storms, necessitating suitable coverage for issues like roof collapses and frozen pipes.

Get the Best Homeowners Insurance in Connecticut Today

Looking to protect your Connecticut home? InsureOne is your best choice. Our experts will research and find the most reliable and cost-effective insurance options for you. Contact us today by phone at (800) 836-2240 or obtain a quick home insurance quote online. If you prefer a personal touch, we invite you to visit one of our conveniently located offices throughout Connecticut. Trust InsureOne to provide the protection and peace of mind your home and family deserve.