North Dakota Homeowners Insurance Quotes

Everything You Need to Know about Home Insurance in North Dakota

North Dakota is one of the states that shares a border with our friendly neighbor to the north, Canada. The Canadian provinces of Saskatchewan and Manitoba are easily accessible to any American with a passport who meets the border crossing requirements. Plenty of North Dakotans work and play in Canada on a routine basis.

Once mainly inhabited by Native American tribes, the name North Dakota comes from the Dakota tribe, a division of the Sioux. The state is one of the least populated in the U.S. and more than 31,000 American Indians are 5% of that population. There are four federally recognized Dakota tribe nations among that group.

Among other early settlers to this vast plain were Scandinavians and Germans from Russia. The English and Celtic pioneers came down through Canada. Today, descendants of these groups make up the large majority of the population here. Famously, Theodore Roosevelt, the 26th president of the United States, spent time in the North Dakota Badlands at the age of 24 after his wife and mother died. He fell in love with the area and the trip transformed him into the man his constituents grew to know and love.

North Dakota has several nicknames, including the Roughrider State (a legacy from Teddy Roosevelt), the Flickertail State (named for an abundant ground squirrel’s tail movements) and the Peace Garden State, the moniker you will see on the state’s license plates. This comes from the word “Dakota” which means “friend” or “ally” and the International Peace Garden on the border between Canada and North Dakota that symbolizes a 1932 pledge by the U.S. and Canada to never go to war with each other.

Homeowners in North Dakota welcome warm summers and cold winters. They also welcome finding top-rated insurance to protect their homes and other belongings – at an affordable price. InsureOne Insurance offers homeowners insurance that meets individual needs with flexible plans.

How Much Does Homeowners Insurance Cost in North Dakota?

Homeowners in the Peace Garden State pay an average of $1,884 per year for $300,000 worth of dwelling coverage, very close to the national average of $1,820.

Dwelling coverage is the amount your insurer agrees to pay to rebuild the physical structure of your home in a covered event.

North Dakota’s flat landscape is prone to disasters such as tornadoes, blizzards and wildfires. The biggest danger facing homeowners and their insurers, however, is flooding. Due to the abundance of snow in this chilly state,

spring runoff has the potential to become raging rivers of water. Insurance rates reflect the types of disasters common to an area, as well as their frequency.

How Do Home Insurance Deductibles Affect Rates in the Flickertail State?

A deductible is part of an insurance policy. It spells out how much the policyholder will kick in for a covered claim. In most cases, a higher deductible will result in a lower premium. It’s important, however, to set a deductible at a reasonable place since you don’t want to hold up payment of a claim due to your inability to come up with the deductible. In some cases, your insurer will simply deduct your deductible from the total payout.

Let’s look at an example of how this works. A prairie wildfire came a little close and your roof caught on fire. Luckily, the fire was extinguished but now you need a new roof. A 1500 square-foot asphalt shingle roof in North Dakota will cost between $5,000 and $9,000. The cost to replace your roof comes in at $6,800 and you’ve set your deductible at $1,000.

This means you will be responsible for paying $1,000 toward the new roof, while your insurance company will pay $5,800.

In the end, the higher your deductible, the lower your annual premium. It’s always best to choose the highest deductible you can afford since it will lower your overall policy cost.

Compare Home Insurance Rates by Coverage Levels in North Dakota

The following table shows the average annual premiums in North Dakota for different levels of dwelling coverage.

| Dwelling Coverage (North Dakota) | Average Annual Insurance Cost |

|---|---|

| $100,000 | $955 |

| $200,000 | $1,411 |

| $300,000 | $1,884 |

| $400,000 | $2,345 |

| $500,000 | $2,813 |

You can find top-rated home insurance with national carriers at a price that will make you happy. Let InsureOne agents do the work for you – providing you with top-notch customer services and flexible plans you can choose from to pick the best one for you.

Is Home Insurance Tax Deductible in ND?

In common with other states and the federal government, North Dakota typically does not allow homeowners to deduct the cost of home insurance from their taxes. There are a few exceptions, including if you have a home office. Check with a tax professional to understand your allowed deductions.

Does the Roughrider State Have the 80% Homeowners Insurance Rule?

Most insurance companies use the 80/20 rule and you’ll probably find it somewhere in your contract. Simply put, your insurer likely requires your home to be insured for at least 80% of its replacement cost value (RCV) before it will pay out fully for an approved claim. If your home is not insured for at least 80% of RCV, your insurer may pay out less than the full amount of an approved claim.

Here is an example. Rebuilding your bungalow in Bismarck today would cost approximately $375,000. In order to meet your insurance contract’s specifications, your dwelling coverage should be at least $300,000 (80% of $375,000). The cost to rebuild is based on current materials and labor costs.

Keep in mind that if you improve your home with renovations and/or additions, the RCV will increase. Similarly, material costs go up every year. It’s important to make sure your dwelling coverage remains at or above 80% of your home’s RCV. Check in with your insurance agent at least annually to make sure you have the appropriate amount of coverage.

Bundling Home and Auto Insurance in North Dakota

Loyalty and ease of administration are two things insurance companies value in their policyholders. If you are happy with your home insurance carrier, consider allowing them to give you a quote for auto insurance, as well. When one company carries two or more of your insured items, this is known as bundling. Bundling can get you one of the largest discounts insurance carriers offer – up to 25% off for bundling home and auto.

There are many benefits to bundling. Policies and claims are easier to manage and administer when it’s all in one package. Your annual renewal (or six-month) will also be easier to keep track of when you use one company.

What Weather Events Affect Home Insurance Costs in ND?

Snow. Snow is one the biggest weather events that may affect the cost of home insurance in North Dakota. Snow is heavy – most roofs in the Peace Garden State are built to withstand this weight, but over time, they will weaken. In the spring, all this snow (more than 50 inches!), melts and may cause flooding. This type of flooding will need a specialized flood insurance policy, which can be purchased from the federal government.

There are ways to prepare for winter’s chill, but frozen pipes inside the home may cause flooding that is typically covered by a home insurance policy. And lastly, due to North Dakota’s flat landscape, wildfires have become an increasing event, which causes insurance costs to rise for everybody.

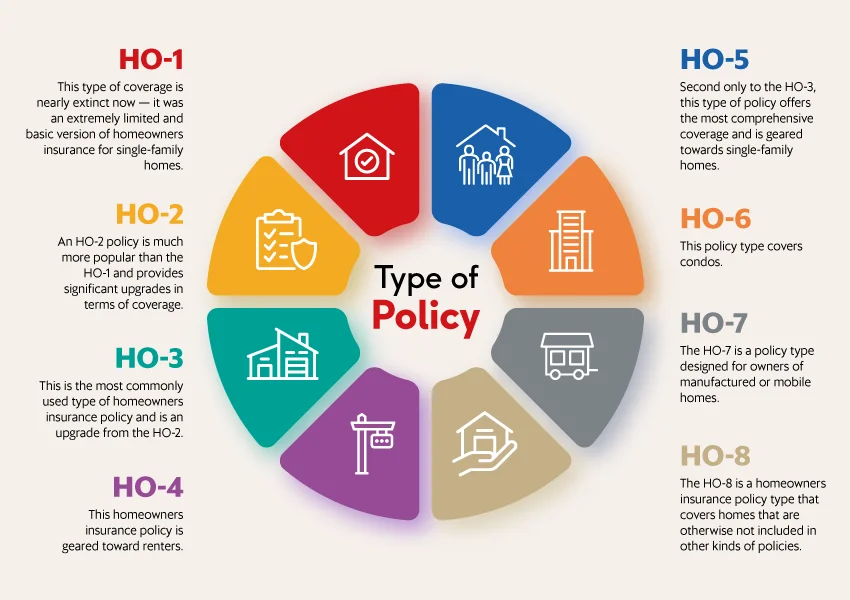

What are the Different Types of Home Insurance?

Whether you own a manufactured home in Minot, a farmhouse in Fargo or a duplex in Dickinson, you need home insurance to keep your financial investment protected. There are 8 types of home insurance – one of those is probably the best for your situation. It’s vital to choose the right type of home insurance. You can trust the team at InsureOne to help you find a flexible policy from a top-rated carrier that meets your individual needs.

What is the Most Common Homeowners Insurance in ND?

It depends on the type of dwelling. For most, an HO-3 policy takes care of the family’s home. Those who choose a manufactured or mobile home will use an HO-7 policy, while someone who purchases a condo will use an HO-6.

Wildfires, blizzards and tornadoes are covered in most policies, so choosing to upgrade to a higher level policy is a choice for the homeowner. For example, an HO-2 policy covers listed “perils” while an HO-3 covers everything except “exclusions”.

Taking the time to understand the coverage you need will ensure your home is adequately protected with the right insurance policy.

Get the Best Homeowners Insurance in North Dakota Today

North Dakotans are a hardy group who love the warmth of the sun as much as they love the blowing snow. They are friendly and the term “North Dakota Nice” is a thing. The state has a low cost of living and jobs available. These are some of the reasons people put down roots here.

If you’ve put down your roots in North Dakota and are looking for top-rated home insurance from a recognizable national brand, let InsureOne help you find it. Our agents do the work for you, taking your information and researching your options to find a flexible and customized solution. Give InsureOne a call at (800) 836-2240 or check their online site today. Or, if you are in the neighborhood, take time to stop in for a one-on-one visit.