Homeowners Insurance Quotes in Paradise, NV

What You Should Know About Home Insurance in Paradise

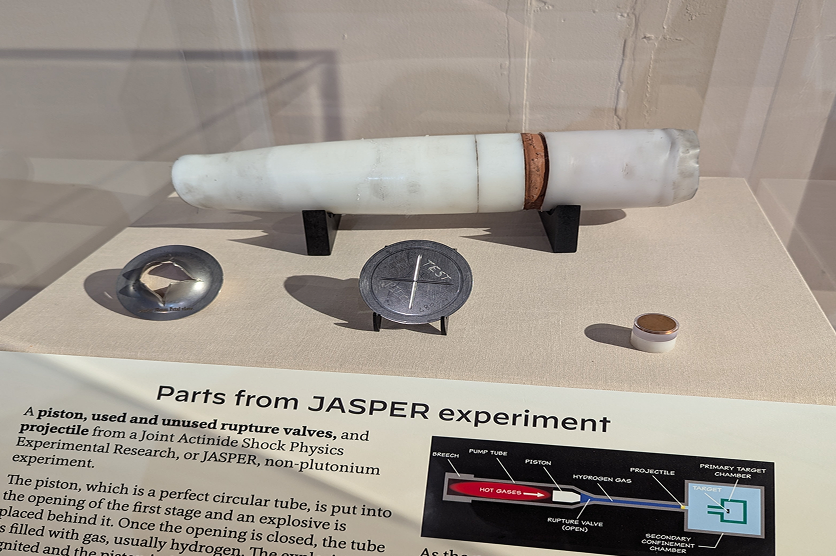

Living just outside the heart of Las Vegas offers a lifestyle unlike anywhere else, and that’s exactly what you’ll find in Paradise, Nevada. This unincorporated community was officially created in 1950 to prevent Las Vegas from annexing the Strip, and it has grown into a vibrant area that blends world-class attractions with everyday living. Home to the Strip, UNLV, the National Atomic Testing Museum and Harry Reid International Airport, Paradise has played a central role in shaping the identity of Southern Nevada.

Residents enjoy a unique balance of excitement and comfort. On one hand, you’re only minutes away from top-tier restaurants, shopping, and entertainment. On the other, quiet neighborhoods, schools, and community parks provide the feel of a suburban lifestyle. While traffic and tourist activity are part of the experience, many homeowners appreciate the convenience and opportunities that come with living in such a dynamic area.

With a community this unique, protecting your home becomes even more important. From fire and theft to unpredictable weather, securing reliable homeowners insurance coverage in Nevada is key to peace of mind. InsureOne makes it easy to compare policies and find the right protection for your property—so you can enjoy all that Paradise has to offer without worry.

How Much Does a Homeowners Insurance Policy Typically Cost in Paradise?

Homeowners in Paradise generally pay less for insurance compared to the national average. Nevada tends to have lower premiums because the state faces fewer large-scale weather risks than many other parts of the country. While rates can vary based on your home’s age, location, and coverage needs, most residents find that their policies are more affordable than what homeowners typically pay across the U.S.

| Dwelling Insurance Total | Average Annual Cost in Paradise | Average Annual Cost Nationwide |

|---|---|---|

| $300K | $1,414 | $2,582 |

| $600K | $2,575 | $4,140 |

| $1 million | $4,061 | $7,380 |

We arrived at these numbers by using the cost of dwelling coverage, a $100,000 liability and a standard $1,000 deductible.

How Do Home Insurance Deductibles Change Insurance Rates in Paradise?

Think of your deductible in Paradise like setting the rules for how you’ll handle surprise expenses. Let’s say a windstorm rips shingles off your roof. If you’ve chosen a high deductible, your monthly rate is lower, but you’ll feel that bigger bill before insurance kicks in. On the other hand, if a burglar breaks a window while you’re out at dinner, having a lower deductible means your insurer will cover more of the repair cost, even for smaller claims.

It’s a bit like choosing between a gym membership with low monthly fees but pricey drop-in classes versus one that costs more upfront but gives you extra perks whenever you need them. The right deductible is about knowing which trade-off makes you feel most comfortable—saving money month to month or easing the financial sting when life throws something unexpected your way.

Is Home Insurance Tax Deductible in Paradise?

Homeowners are sometimes unaware that their insurance premiums don’t usually qualify for a tax deduction. The IRS views the cost of protecting your home as a personal expense, much like utilities or groceries.

That said, there are some useful exceptions. If you run a business out of your home, you can typically write off the portion of your premium that covers your office space. Rental properties also qualify since insurance is considered part of the cost of managing that income. And in certain disaster situations, uncovered losses tied to federally declared emergencies may be deductible.

While your everyday policy won’t lower your tax bill, these exceptions can make a difference depending on how you use your homes. Not sure if you qualify? A quick chat with a tax professional can help you make the call.

Does Paradise Have the 80% Homeowners Insurance Rule?

Think of the 80% rule as the fine print that can make or break your coverage. It’s not a city law, but many insurance companies expect you to insure your home for at least 80% of its replacement value. Picture this: if it would cost $250,000 to rebuild your home and you only insure it for $150,000, you’re taking a gamble. Even a smaller claim—like fixing storm damage to your roof—could leave you paying out of pocket because you didn’t meet the 80% threshold.

That’s where InsureOne comes in. Our agents are like insurance matchmakers—pairing your home with the right level of protection so you’re never caught short. We’ll make sure you’re covered the way your insurer expects, while also keeping your budget in check. With us, you’ll know your home is properly protected and you won’t be stuck with any expensive surprises.

Bundling Home and Auto Insurance in Paradise

Why juggle multiple bills and logins when you can keep things simple—and save money at the same time? Bundling home and auto insurance means putting both policies with the same carrier, and in return, most companies give you a nice discount. On top of the savings, it’s way easier to manage everything in one place. From protecting your house to making sure your auto coverage keeps you safe on the road, bundling is like streamlining your life with a bonus perk.

InsureOne makes it even better by tailoring bundles to match your exact needs. Maybe you’ve got a dream home that needs full protection, or a car that racks up daily miles and needs solid coverage—we’ll shape a package that fits your world and your budget.

And the best part? You don’t have to shop around yourself. Our agents do the heavy lifting, comparing carriers and finding the deals that save you money. With InsureOne, bundling home and auto insurance in Paradise isn’t just smart—it’s stress-free.

How Does Home Composition Impact Insurance Rates?

In Nevada’s desert climate, what your home is made of really matters when it comes to insurance. A house built with stone or brick tends to score lower premiums because those materials are naturally more resistant to fire—an important factor in a state where wildfires are part of life. The catch? If serious damage does happen, stone and brick are pricey to repair, so insurers keep that in mind.

Wood-frame homes tell a different story. They’re easier and cheaper to build, but they don’t stand up as well to Nevada’s dry heat or flash flooding. That extra vulnerability can push insurance costs higher. Then there’s stucco—a favorite across the state. It’s durable, fire-resistant, and better suited for the desert, which makes it a practical and often more affordable choice in the eyes of insurers.

At the end of the day, your home’s bones shape your rates just as much as its size or location. Knowing whether you’re working with wood, brick, stone, or stucco helps you plan for the right protection. InsureOne can step in to break down those details and make sure your coverage matches the strengths—and weak spots—of your Nevada home.

What Are the Different Types of Homeowners Coverage Offered in Paradise?

Homeowners insurance comes in different shapes and sizes, and there are 8 standard policy types you can choose from. Which one is right for you depends on how you live and what you own. In Paradise, here are a few that stand out:

- HO-1 (Basic Form): Offers the bare minimum protection, covering only a handful of risks like fire and theft. It’s rarely used today but still an option for those seeking the lowest cost.

- HO-2 (Broad Form): Expands coverage to a longer list of perils, including events like windstorms or falling objects, giving you more peace of mind than basic protection.

- HO-3 (Special Form): The most common policy for single-family homes, covering your house against nearly all risks except those specifically excluded, with personal property protected against named perils.

- HO-5 (Comprehensive Form): Offers one of the highest levels of protection, covering both your home and belongings on an “open-perils” basis, meaning most unexpected events are included unless excluded.

Whether you’re a first-time buyer or upgrading your current home in Paradise, InsureOne agents can help you sort through these options and find a policy that truly fits your lifestyle.

What Is the Most Common Type of Home Purchased in Paradise?

When people move to Paradise, they’re usually chasing more than just a roof over their heads—they’re looking for a lifestyle. That’s why single-family homes are the top pick here. They give you breathing room, privacy, and the freedom to make the space truly yours.

Imagine a backyard for weekend cookouts, a garage for your toys or tools, and a home that grows with you over time. It’s no surprise families, professionals, and even first-time buyers lean toward this kind of setup.

Of course, with such a big investment, making sure you’ve got the right homeowners insurance coverage is non-negotiable. And down the road, if you’re navigating HOA rules or figuring out how to switch home insurance providers without losing coverage, InsureOne’s experts can make it all feel a whole lot simpler.

Which Common Natural Disasters Are Covered by Home Insurance in Paradise?

Life in Paradise has plenty of sunshine and excitement, but the desert climate can also bring its fair share of surprises. The good news? A standard homeowners policy usually has your back for some of the big ones:

- Wildfires: Dry Nevada heat plus a spark can spell trouble fast. Luckily, most policies cover fire and smoke damage, protecting both your home and your belongings.

- Windstorms: Those desert gusts aren’t just a bad hair day—they can rip off shingles, knock over fences, or send debris flying. Home insurance typically covers the cleanup.

- Hail and Severe Storms: It doesn’t happen every day, but when hail or sudden storms roll through, they can do a number on roofs and siding. Most standard coverage includes this type of damage.

One important detail: not everything is covered automatically. Floods and earthquakes usually need separate policies. At this point, InsureOne can guide you—we’ll help you sort out what’s included, what’s missing, and how to make sure your Paradise home is fully ready for whatever the desert skies decide to throw your way.

Get the Best Homeowners Insurance in Paradise with InsureOne Today

Life in Paradise has its perks—sunny days, lively neighborhoods, and the buzz of the Strip just minutes away. With so much going on outside your front door, you deserve homeowners insurance that keeps pace. That’s exactly what InsureOne is here for. We’re more than just an insurance provider—we’re your personal concierge, making the search for coverage as effortless as a walk down the Strip.

Our agents listen. We take the time to understand what matters most to you—whether it’s keeping premiums manageable, protecting the upgrades you’ve worked hard for, or adding peace of mind against Nevada’s unique risks.

At the end of the day, your home in Paradise should feel secure, and your insurance should feel simple. With InsureOne, you get protection designed around your lifestyle and budget—so you can stop stressing over policies and start enjoying the good life right where you are.

You can visit our website for a free quote, drop by one of our locations, or get started with a phone call at (800) 836-2240.