Find Car Insurance in Borger, TX

What You Should Know About Car Insurance in Borger, TX

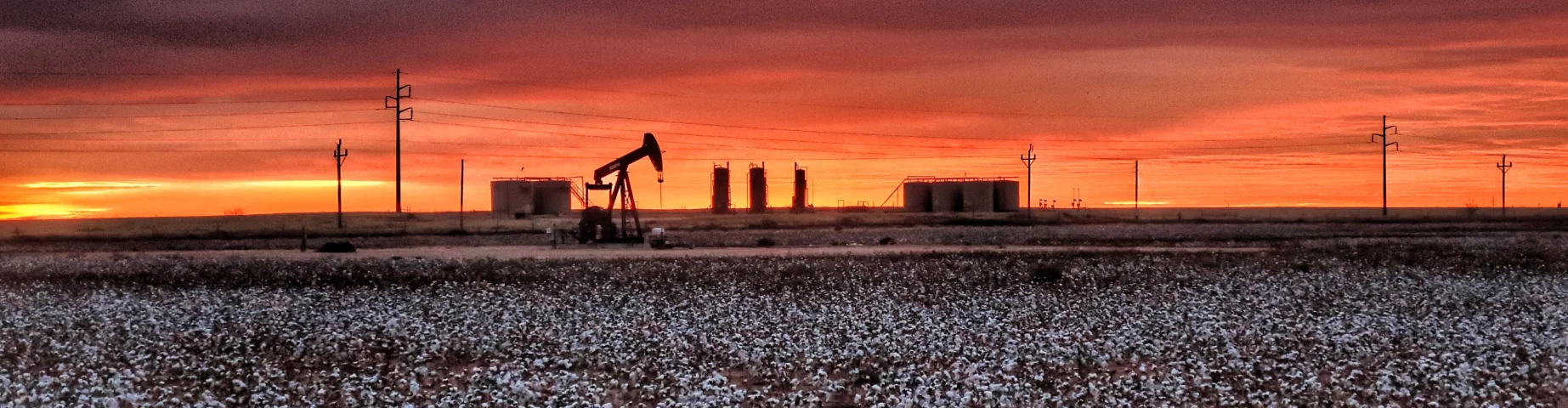

As a city, Borger is a latecomer to the U.S., having only been established in 1926. The year of its founding, oil was discovered, drawing 45,000 opportunists to the city. Though the excitement quickly waned, the petroleum industry remained an important part of the town’s economy and plays a vital role even today. Borger’s current population of just over 12,500 enjoys an impressive business roster that includes the likes of Phillips 66, Nutrien U.S., and Chevron Phillips.

Getting around this small city’s 8.79 square miles by car is pretty easy and does not take very long. To protect yourself financially as you pass through Borger, an expert InsureOne agent can help you obtain the best auto insurance at the best prices available.

How Much Does Car Insurance Cost in Borger, Texas?

Living in this state has many advantages, and one of them is that you can get car insurance in Texas at an affordable price. A full coverage policy costs approximately $2,019 yearly, pretty close to the national average of $2,014. A minimum liability policy will only cost you $565, significantly less than the $622 average for the rest of the country.

Why Is Insurance So Cheap in Texas?

Two of the factors that lead to affordable auto coverage are low accident rates, which would mean that insurers are not paying out too many claims, and a low cost of living, which minimizes the cost of repairs when an insurer does have to pay a claim. The cost of living in Texas is well below the national average, and although the Lone Star State just about leads the nation in accidents, the rate of accidents per licensed driver in Texas is lower than most other states. These two factors might explain why the cost of a minimum liability policy is so cheap in this state.

Affordable Car Insurance Rates Comparison by Cities in Texas

Local conditions in your city affect how much you will pay for auto coverage. The following chart compares monthly rates between Borger and several nearby cities.

| City | Full Coverage Insurance | Liability Insurance Coverage |

|---|---|---|

| Borger | $157 | $36 |

| Amarillo | $171 | $43 |

| Fritch | $161 | $37 |

| Panhandle | $165 | $38 |

| Stinnett | $158 | $35 |

How Bundling Your Car and Homeowners Insurance Can Save You Money in Borger

As a homeowner, you should look into bundling your home and auto insurance. Bundling means getting multiple policies with the same carrier. When you bundle, you conveniently deal with a single company for everything from signing up to managing your bills and filing claims. You can also save a lot of money by bundling, such as up to 25% on your premiums if you get both your auto and homeowners insurance from the same insurer.

Leave all the hard work involved in maximizing savings through bundling to your expert InsureOne agent. They will price out several carriers and customize a package that helps you take advantage of the benefits of bundling and will deliver a customized package of policies at affordable prices.

What Types of Car Insurance Discounts Are Available in Borger?

If you are like every other car owner in Texas, you would probably love to lower your insurance premiums even further. You can accomplish this by taking advantage of the many discounts insurers offer. These are some examples you can mention to your InsureOne agent:

- Paperless billing discount

- Auto-pay discount

- Safety feature discount

- Paid-in-full discount

- Military discount

Notable Car Insurance Laws in Borger

Individual cities in Texas do not have their own insurance laws. The following are some of the state rules and regulations that affect the coverage of the citizens of Borger and the rest of the state.

What Are the Mandatory Car Insurance Requirements in Borger?

Under Texas law, every licensed driver must obtain state minimum liability coverage. Other states have similar policies in place, each requiring its own minimum levels of coverage. These are the requirements for drivers in the Lone Star State:

- $30,000 liability coverage for bodily injury per person

- $60,000 liability coverage for bodily injury per accident

- $25,000 liability coverage for property damage

What Is the Penalty for Driving Without Insurance in Borger?

Driving without insurance can cost you a lot of money because if you cause an accident, you will not have an insurer that will help you pick up the tab for the damages you cause. In the state of Texas, you would also be subject to these fines and penalties:

- $175 to $350 fine, possibly lower in cases of economic hardship

- $350 to $1,000 fine for a second offense

- A yearly insurance surcharge of $250 for three years

- Possible license suspension

- Possible vehicle impoundment

Do Borger-Specific Laws Play a Role in Determining Your Insurance Premiums?

Insurers delve into many details about you and the vehicle you intend to insure. The following are some of the factors Texas law allows carriers to use as they determine your premium amounts.

- The cost of your vehicle: The more your car costs, the more your insurer will have to pay if it is totaled in an accident you cause or if it is stolen.

- The type of vehicle: A minivan is considered a family car that is less likely to get into an accident than a car that a teenager would drive.

- Driving experience: Drivers with many years of experience are considered less likely to cause a crash than newer drivers.

- Mileage: Insurers assume that the fewer miles you travel in a year, the lower the chance of you getting into an accident.

- Loss probability: Your carrier will check statistics like theft and accident rates in your zip code before giving you a quote.

Insurance That Helps You Prepare for the Future

Just like you put away money for your kids’ future college tuition, in a world without insurance, you would have to bank funds in case you ever cause an accident. You would not know how much to save since it is impossible to know what the damages might amount to in a potential accident. A crash can cause $100,000 in damages almost as easily as it can cause $10,000 in damages.

Having an auto policy in place gives you the assurance you need that should you ever cause an accident, your insurer will help you pay for the damages. It gives you the opportunity to save money for the important things in life. At InsureOne, our expert agents help you find the best auto insurance with customizable options that best meet your needs so you can start planning for your future.

Typical Driving Conditions in Borger

Highways 207, 136, and 152 pass through Borger, giving residents easy access in and out of town. The city gets some rainfall, during which roads can be slippery. It is sunny just about every day of the year in Borger, which can be blinding for drivers at times. Temperatures range from the 80s to the mid-90s from May through September, and extreme heat can affect a driver’s mood.

How Many Car Accidents Happen in Borger Per Year?

The Texas Department of Transportation reports the following as total crashes in Borger and several nearby cities in 2023:

| City | Total Crashes |

|---|---|

| Borger | 145 |

| Amarillo | 4,092 |

| Fritch | 5 |

| Panhandle | 2 |

| Stinnett | 1 |

How Many Uninsured/Underinsured Motorists Are in Borger?

In 2022, 13.8% of Texas drivers were uninsured, according to the Insurance Information Institute. TexasSure estimates that 20% of drivers in the state were uninsured.

Get Covered by the Best Car Insurance in Borger, Texas, Today

Taste the small-town feel of Borger by driving through its street. Enjoy the quiet as you enjoy the peace of mind that comes with having the best insurance policy available in place.

Our InsureOne expert agents can get you just that. We are a one-stop shop for all your insurance needs and can get you customized policies that match your needs at the best prices if you stop by one of our physical locations, call us at (800) 836-2240, or visit our website.